Introduction

HM Revenue and Customs (HMRC) plays a vital role in the UK’s financial landscape, managing the collection of taxes and disbursing refunds when applicable. As many individuals and businesses navigate their tax obligations, receiving a tax refund letter from HMRC can be both reassuring and confusing. Understanding the significance of these letters, how to interpret them, and the necessary steps to take can help taxpayers ensure they are receiving their rightful refunds and complying with tax laws.

What are HMRC Tax Refund Letters?

Tax refund letters are official communications sent by HMRC to notify taxpayers that they are due a refund for overpaid taxes. This could occur due to a variety of reasons, including changes in income or tax code errors. HMRC may initiate a refund automatically, or taxpayers may need to claim it after assessing their financial circumstances.

Recent Developments Regarding Tax Refunds

In recent months, there has been a significant uptick in the number of tax refund letters issued by HMRC, particularly following the end of the tax year in April. The adoption of the Making Tax Digital initiative has also transformed how refunds are assessed and issued. As more taxpayers are encouraged to file their returns online, the efficiency of the refund process has improved, reducing waiting times associated with manual assessments.

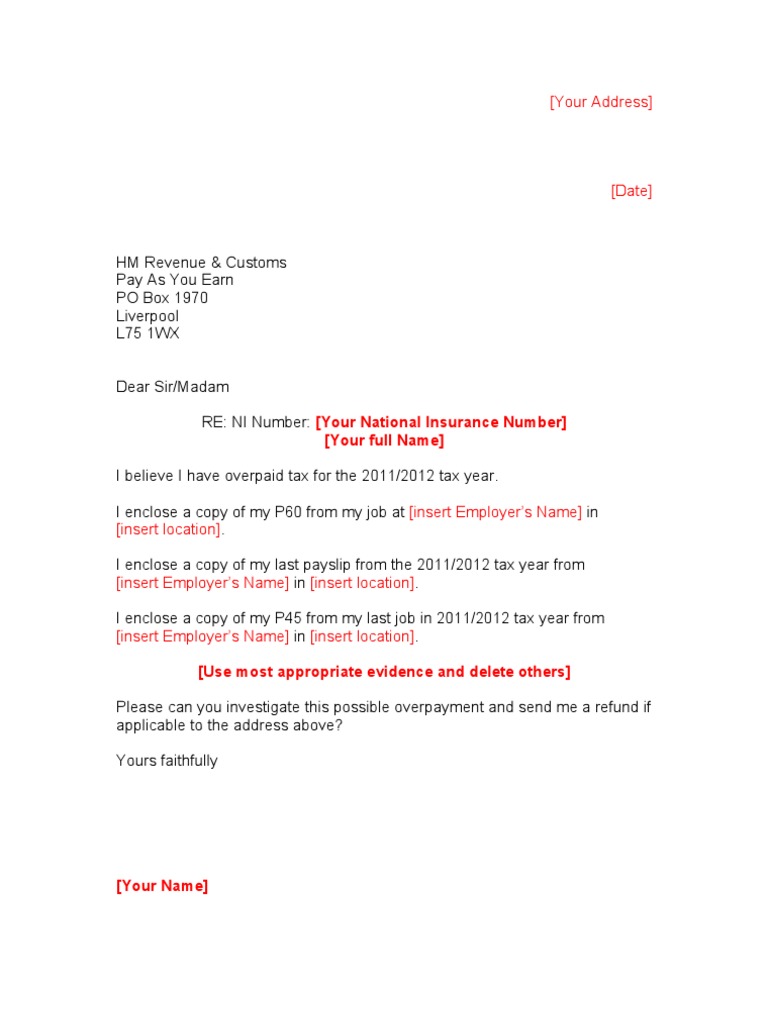

Identifying a Legitimate Refund Letter

In an age where scams are increasingly common, it’s crucial for taxpayers to recognise what a genuine HMRC tax refund letter looks like. Legitimate letters will typically feature HMRC branding and provide clear details regarding the individual’s tax history, the amount of the refund, and the method by which it will be paid. Taxpayers should be cautious of emails or messages purporting to be from HMRC that ask for personal information, as these may be phishing attempts.

What to Do Upon Receiving a Refund Letter

Receiving a tax refund letter is generally good news, but taxpayers should take a few important steps:

- Review the Details: Carefully check the contents of the letter to ensure the figures align with your own records.

- Contact HMRC if Necessary: If there are discrepancies, or if a letter appears suspicious, reach out to HMRC directly using contact details from their official website.

- Consider Tax Implications: Consult with a tax adviser to understand the implications of the refund on current or future financial situations.

Conclusion

HMRC tax refund letters are an essential aspect of the tax system in the UK, enabling taxpayers to reclaim overpayments efficiently. With improved processes due to digital advancements, the communication of refunds is becoming clearer and faster. It remains important for taxpayers to remain vigilant, ensure the legitimacy of the communications they receive, and seek help when needed. As fiscal policies continue to evolve, staying informed will help ensure all individuals and businesses achieve their proper entitlements while navigating tax responsibilities.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price