The Importance of Bank Accounts in the UK

In the contemporary financial landscape, having a bank account is essential for managing personal finances effectively. With the rise of digital banking and the increasing need for electronic transactions, understanding the nuances of bank accounts in the UK has become more relevant than ever.

Types of Bank Accounts Available

In the UK, there are several types of bank accounts catering to diverse needs:

- Current Accounts: These are the most common type of bank account used for daily transactions, including payments, deposits, and withdrawals. They typically offer features like online banking, debit cards, and overdraft facilities.

- Savings Accounts: Designed for saving money, these accounts usually offer higher interest rates compared to current accounts. They can be instant access or fixed-term, with varying withdrawal regulations.

- Joint Accounts: These accounts are shared between two or more people, ideal for couples or family members who wish to manage shared finances.

- Specialised Accounts: Many banks offer accounts tailored for specific groups, such as students, seniors, or businesses, which may come with unique benefits and lower fees.

Current Trends in UK Banking

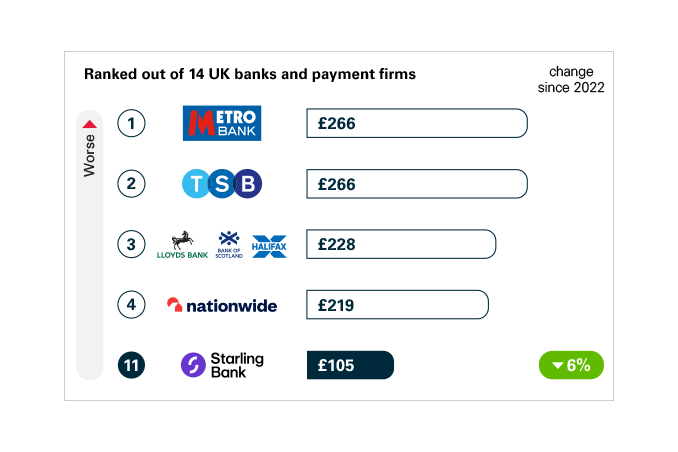

Recent studies indicate a growing trend towards online-only banks, also known as ‘challenger banks’. These institutions often provide lower fees, user-friendly apps, and better interest rates than traditional banks. According to a report by the British Bankers’ Association, nearly 30% of consumers have switched to an online bank in the past two years.

Regulatory Framework

In the UK, bank accounts are protected by the Financial Services Compensation Scheme (FSCS), which secures deposits up to £85,000 per person, per institution. This scheme plays a crucial role in boosting consumer confidence, ensuring that depositors can recover their funds in the event of a bank failure.

Conclusion and Future Outlook

As the banking industry continues to evolve with technological advancements, consumers must stay informed about their choices regarding bank accounts. The rise of fintech solutions is likely to further enhance competition, leading to better services and lower costs for consumers. Understanding the various types of bank accounts and their benefits will empower UK residents to make informed financial decisions that best suit their lifestyles.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

The Importance and Relevance of MFC in Modern Development

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial