Introduction

In recent years, Revolut has emerged as a key player in the financial technology sector, reshaping how individuals manage their money. Founded in 2015, the UK-based neobank aims to simplify banking by offering a range of innovative financial services, from international payments to cryptocurrency trading. With over 20 million users globally, understanding Revolut’s impact on traditional banking is crucial for consumers and industry analysts alike.

What is Revolut?

Revolut offers a digital banking app that allows users to conduct various financial transactions without the need for a conventional bank. Its features include currency exchange, debit cards, budgeting tools, and stock trading. Most notably, Revolut provides users with the ability to hold and exchange 30 different currencies at the interbank rate, which streamlines international travel and online shopping for its users.

Recent Developments

Revolut has made headlines in recent months with its expansion into new markets and the introduction of innovative services. In September 2023, Revolut expanded its product offering by introducing ‘Revolut Rewards’, a cashback program that allows users to earn points for transactions, potentially fostering customer loyalty. Additionally, the company is in the process of obtaining banking licenses in different jurisdictions to enhance its regulatory standing, which is critical in an era of increased scrutiny within the fintech industry.

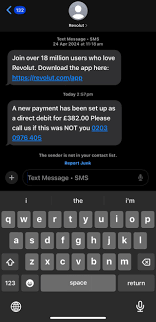

Challenges and Criticism

Despite its ambitious growth, Revolut has faced challenges, including regulatory hurdles and criticism over its customer service practices. In early 2023, the Financial Conduct Authority (FCA) imposed fines on the company for failing to protect consumer funds adequately. The company has since taken steps to improve compliance but must continue to demonstrate its commitment to user safety and trust as it navigates a highly competitive landscape.

Conclusion

Revolut’s innovative approach to banking has undoubtedly changed the financial services landscape, appealing particularly to tech-savvy consumers seeking more control over their finances. As it expands and adapts, the company’s ability to address regulatory challenges and improve customer service will be crucial for its long-term success. For users, staying informed about Revolut’s developments and offerings can lead to better financial decisions, especially in an increasingly digital world.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial