Introduction

Understanding the share price of major investment firms like Schroders is crucial for investors and stakeholders alike. As a prominent fund management company, Schroders plays a vital role in the financial markets, and its share price often reflects broader economic conditions and investor sentiment. In recent weeks, Schroders has experienced notable fluctuations, raising questions about its future direction.

Current Performance

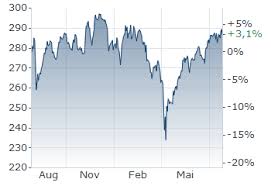

As of mid-October 2023, Schroders’ share price is approximately £30.50, which marks a slight decline compared to the previous month where it hovered around £31.20. This dip can be attributed to various global factors, including concerns over interest rate hikes and inflation that have been affecting the fund management sector. Moreover, analysts have noted a decrease in assets under management (AUM) in recent quarterly reports, contributing to cautious investor sentiment.

Market Influences

Several factors have influenced the downward trend in Schroders’ share price. The ongoing geopolitical tensions and uncertainties in Europe have led investors to adopt a more risk-averse approach. Furthermore, rising costs and a potential slowdown in economic growth are pressuring the profitability of asset management firms. Specifically, Schroders’ revenue saw a decline of approximately 5% year-on-year in its latest earnings report, prompting analysts to downgrade their forecasts for the upcoming quarter.

Strategic Responses

In response to the challenging market conditions, Schroders has initiated several strategic measures to bolster its position. The company is focusing on enhancing its digital investment services and expanding its private assets offering, targeting high-net-worth individuals and institutional investors. Such initiatives aim to diversify its product portfolio and attract more investment, which could ultimately support share price recovery in the long term.

Conclusion

While the current trend of Schroders’ share price presents challenges, the firm’s proactive approach in addressing market conditions could provide optimism for investors. Analysts suggest that if the company successfully adapts to the evolving landscape and capitalises on growth opportunities such as emerging markets and alternative investments, it could stabilise its share price. Investors should remain vigilant and monitor not only Schroders’ performance but also broader market signals to make informed decisions.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial