Understanding the State Pension Age: Current Changes and Implications

Introduction to State Pension Age

The state pension age (SPA) is a critical factor influencing the financial security of millions of retirees across the UK. With changes to life expectancy and government policy, understanding the state pension age is essential as it directly impacts individuals’ retirement planning.

Current State Pension Age in the UK

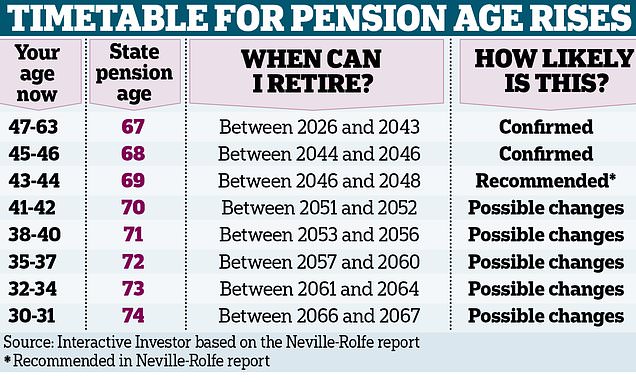

As of October 2023, the state pension age for men and women in the UK is set at 66 years. This will gradually rise to 67 between 2026 and 2028, according to the latest government guidelines. By 2046, it may even extend to 68 years or more, depending on ongoing reviews and rising life expectancy trends.

Changes and Reasons for Adjustments

The adjustments to the state pension age have been largely influenced by increases in life expectancy, with people living longer due to improvements in healthcare and lifestyle. The government aims to ensure that the state pension system remains sustainable and aligned with these demographic changes. Additionally, the rising cost of pensions relative to the working-age population necessitates such reforms.

Impact on Future Retirees

These changes mean that individuals planning for retirement need to be more proactive in their savings and investment strategies. Transitioning to an older age threshold for receiving state pension benefits can impact financial planning significantly. Potential retirees should consider alternative sources of income, such as workplace pensions or personal savings.

Conclusion and Future Outlook

The state pension age is a crucial element of the UK’s pension system, shaping the retirement landscape for future generations. With potential increases on the horizon, it is important for individuals to stay informed about their eligibility and to plan accordingly. As the government continues to assess the impact of demographic changes on the pension system, further adjustments may be required, making it essential for readers to keep abreast of policy updates to ensure a secure financial future.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price