The Importance of Mortgages in Today’s Market

Mortgages are a crucial financial tool for millions of people looking to purchase homes across the United Kingdom. With rising property prices and economic fluctuations, understanding mortgages has never been more important. As the demand for housing continues to surge, potential homebuyers must navigate an ever-evolving lending landscape.

Current Trends in the Mortgage Market

As of late 2023, the UK mortgage market has seen significant changes, primarily driven by interest rate adjustments and government interventions aimed at stabilising the housing sector. The Bank of England has maintained a cautious approach, with varying interest rates impacting affordability and borrowing costs. Recent data from the UK Finance show a notable increase in fixed-rate mortgage applications as buyers lock in rates amid fears of future hikes.

Additionally, first-time buyers face unique challenges. According to the Office for National Statistics, the average deposit for first-time buyers has risen by 10% since last year, leading many to seek help from government schemes such as Help to Buy and Shared Ownership options.

The Types of Mortgages Available

Homebuyers in the UK typically encounter several types of mortgages, including:

- Fixed-rate Mortgages: These loans offer a set interest rate for a predetermined period, providing stability in monthly payments.

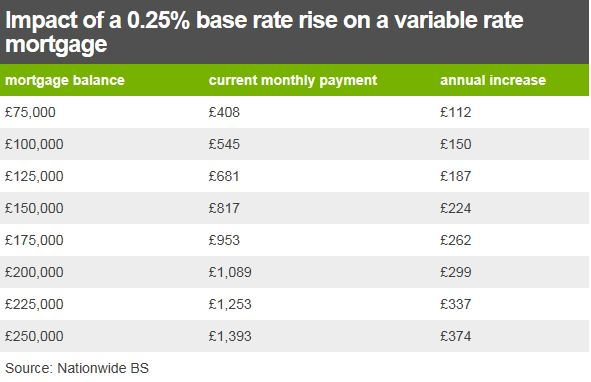

- Variable-rate Mortgages: These mortgages have interest rates that can fluctuate based on market conditions, typically offering lower initial rates but potentially increasing costs over time.

- Interest-only Mortgages: Borrowers pay only the interest for a set period, which can lead to lower monthly payments but requires careful financial planning for the eventual repayment of the principal.

Conclusion: What Lies Ahead for Mortgage Borrowers?

As we advance into 2024, the mortgage market is expected to remain dynamic, influenced by economic stability and governmental policies. Homebuyers will need to be more informed and prepared to secure the best deals in the face of rising costs and fluctuating interest rates. Experts advise potential buyers to seek professional financial advice and carefully assess their options to ensure they choose a mortgage that aligns with their long-term financial goals. The significance of understanding mortgages cannot be overstated, as they represent not just a financial commitment but also the foundation of homeownership and personal security in the UK.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price