Introduction

The state pension age is a significant aspect of retirement planning for millions of individuals in the UK. It determines when citizens can begin to receive their state pension payments, which serve as a crucial source of income in retirement. Recent reforms and discussions pertaining to the state pension age have heightened public interest, making it essential for individuals to be informed about upcoming changes and their potential impact.

Current State Pension Age

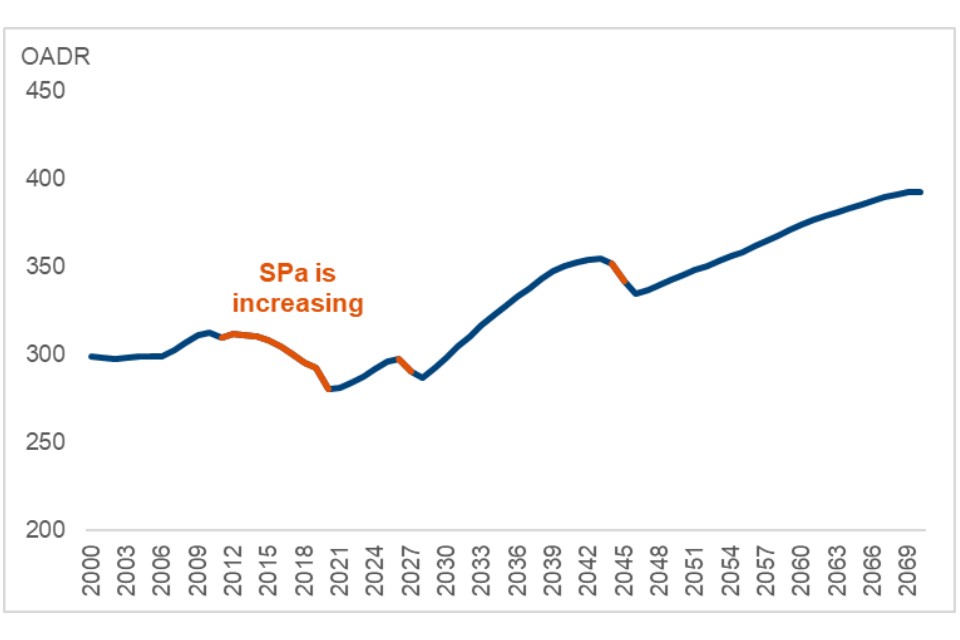

As of 2023, the state pension age is 66 for both men and women, having increased gradually over the years. The government has plans to further raise this age to 67 between 2026 and 2028 and potentially even to 68 by the mid-2030s. These adjustments are largely driven by demographic changes, including increased life expectancy and a rising number of retirees compared to the working-age population.

Recent Developments

The UK government’s decision to review the state pension age has been influenced by economic factors and public feedback. In 2021, the government conducted a review of state pension age policies, which considered various aspects such as social equity, economic sustainability, and fairness to younger generations. In a report released in late 2022, the Secretary of State for Work and Pensions stated the importance of gradual adjustments rather than abrupt changes to ensure that individuals have adequate time to prepare.

Implications of Changes

Raising the state pension age carries several implications for both current workers and future retirees. Individuals nearing retirement may need to adjust their savings strategies or employment plans if they face delays in receiving their pension. For younger generations, the higher state pension age may necessitate a longer duration of savings and retirement planning. Furthermore, the economic impact of a larger workforce staying in employment longer can influence the labour market and economic growth.

Conclusion

Staying informed about the changing state pension age is crucial for anyone planning their financial future. Given the government’s ongoing discussions regarding potential reforms, individuals should consider seeking guidance from financial advisors to prepare for their retirement effectively. As the state pension age continues to face adjustments in response to demographic trends, proactive planning becomes ever more vital to ensure financial security in retirement.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial