Introduction

Inflation remains a critical topic of discussion in the UK as its implications stretch across various facets of the economy and daily life. In 2023, the UK economy continues to face challenges related to rising prices, affecting purchasing power and economic stability. Understanding the current state of inflation is essential for consumers, businesses, and policymakers, as it influences everything from interest rates to cost of living adjustments.

Current Inflation Trends

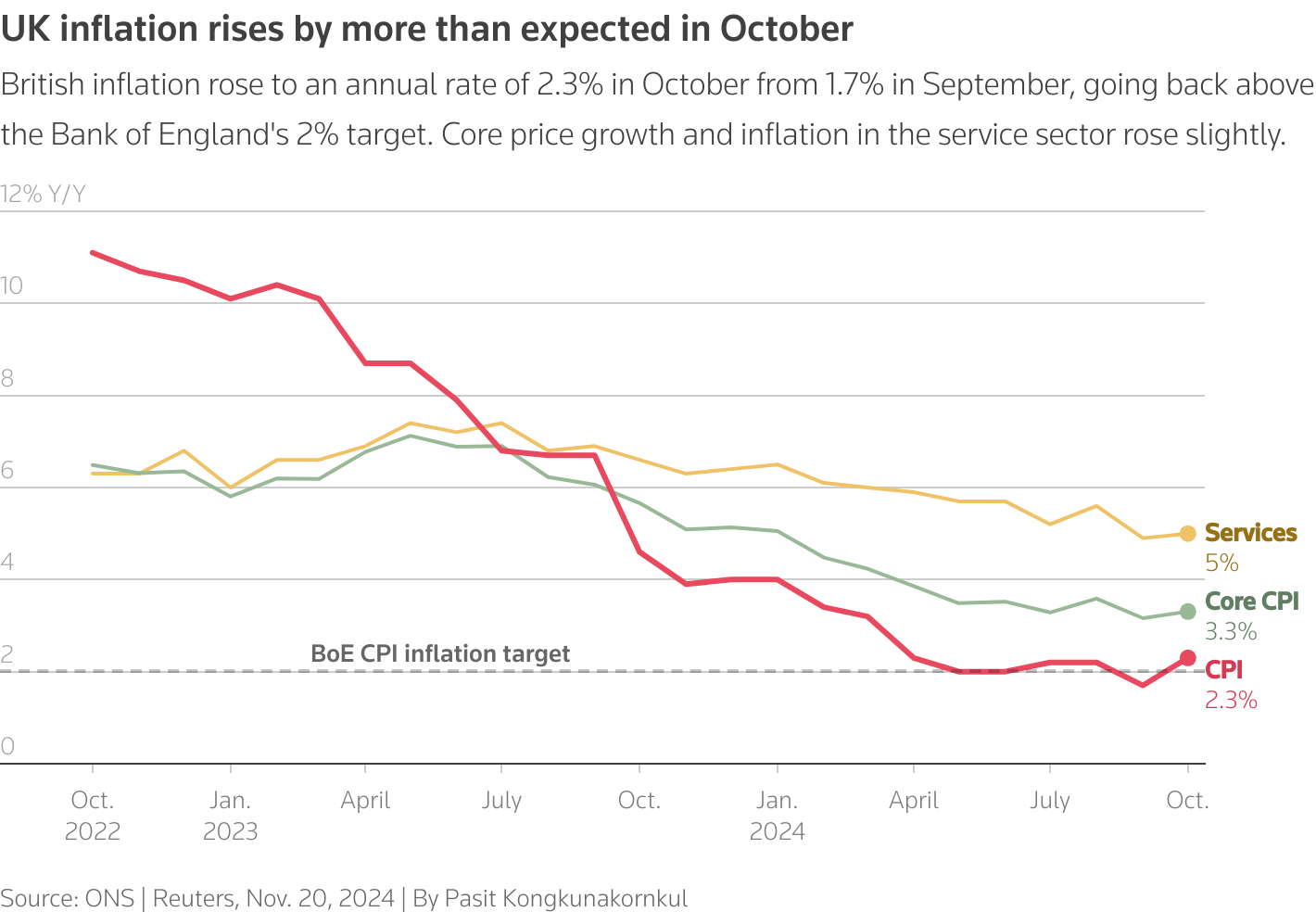

As of October 2023, the Consumer Prices Index (CPI) shows that the inflation rate in the UK stands at approximately 6.2%, a decrease from the highs witnessed earlier this year, which hit over 9%. The primary drivers of this softer inflation include stabilising energy prices and a gradual easing of supply chain issues that have plagued sectors since the onset of the pandemic. However, food prices remain stubbornly high, with some staples recording increases of up to 15% year-on-year, further stressing household finances.

Government and Bank of England Response

The UK government and the Bank of England (BoE) have been actively monitoring inflationary pressures. In response to the previous inflation spikes, the BoE raised interest rates multiple times, reaching 5.5% to combat inflation. Recently, the bank has indicated a more cautious approach to further rate increases, easing concerns about potential economic slowdown. Chancellor of the Exchequer, Jeremy Hunt, has also called for measures to support households struggling with living costs, including targeted energy support and focus on food supply stability.

Impact on Consumers and Businesses

The lingering high inflation has direct consequences for UK consumers, who are experiencing increases in everyday expenses. The ongoing rise in housing costs, alongside soaring energy and food prices, has made it increasingly challenging for families to maintain their standard of living. Businesses, especially small and medium enterprises, are grappling with higher operational costs and narrowing profit margins, prompting some to increase prices or reduce staff to maintain viability.

Conclusion

In conclusion, while the UK inflation rate is showing signs of moderation, challenges remain that require continued attention from policymakers. Rising costs of living and the potential for economic strain remain significant concerns for UK households and businesses alike. Looking ahead, economic experts predict a gradual decline in inflation rates into 2024, but this will largely depend on global economic conditions and local policy responses. Stakeholders are advised to stay informed and prepare for ongoing adjustments influenced by these shifting economic landscapes.

You may also like

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price