The Impact of Federal Reserve Interest Rates on the Economy

Introduction

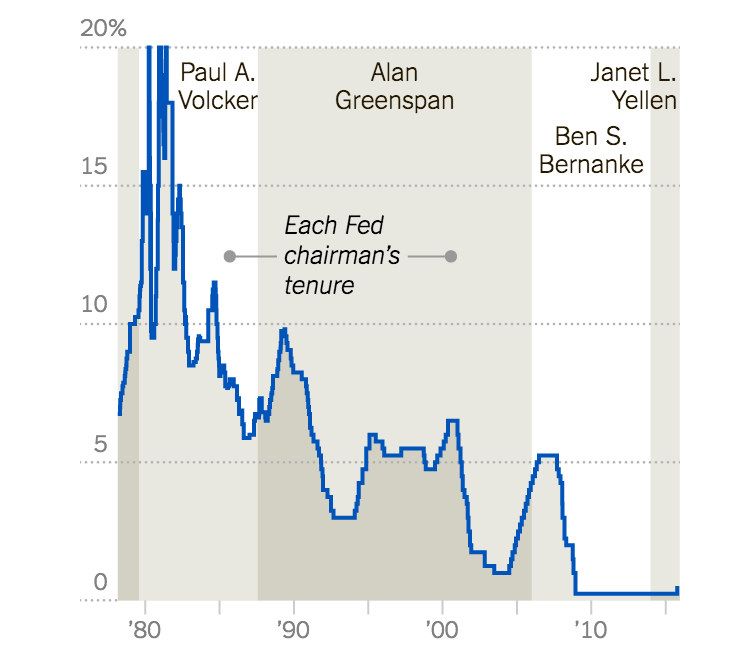

The Federal Reserve’s interest rates are a crucial component of the United States economic landscape. Changes in these rates can significantly influence consumer behavior, business investment, and overall economic growth. Recent adjustments have sparked widespread discussion about their long-term implications amidst evolving economic conditions.

Recent Developments

As of October 2023, the Federal Reserve has maintained a cautious stance on interest rate adjustments amid rising inflation pressures. In its latest meeting, the Federal Open Market Committee (FOMC) decided to hold rates steady at 5.25% to 5.50% to assess the lingering impacts of previous hikes. This decision comes in light of a mixed economic outlook, with some sectors showing resilience while others, particularly housing and retail, exhibit signs of strain.

In a move to combat persistent inflation, which has remained above the Fed’s target of 2%, analysts are closely monitoring future rate changes. The Fed’s chair, Jerome Powell, reiterated the importance of a data-driven approach, stating that decisions will be contingent on incoming economic data, particularly employment figures and consumer spending trends.

Economic Implications

The Federal Reserve’s interest rate policies carry significant implications for various aspects of the economy. Higher interest rates typically lead to increased borrowing costs for consumers and businesses, potentially dampening spending and investment. Conversely, lower rates can stimulate economic growth by making credit cheaper. The challenge for the Fed is finding the right balance to foster economic growth while keeping inflation in check.

Mortgage rates have remained elevated, affecting home-buying activities, especially for first-time buyers. The construction sector also faces challenges with the costs of financing projects rising, leading to concerns about slowed economic recovery in that area. Furthermore, the stock market often reacts negatively to anticipated rate hikes, reflecting investor apprehension about increased borrowing costs impacting corporate profits.

Conclusion

In conclusion, the decisions made by the Federal Reserve regarding interest rates profoundly influence the economic landscape of the United States. As the Fed navigates the fine line between curbing inflation and encouraging economic growth, both consumers and businesses must remain alert to the potential impacts on their financial decisions. Moving forward, analysts expect continued scrutiny of macroeconomic indicators, suggesting further adjustments could be on the horizon. Understanding these dynamics is crucial for readers looking to grasp the intricacies of the economy.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Status of the Bank of England Base Rate