Introduction

The Driver and Vehicle Licensing Agency (DVLA) tax is a vital aspect of vehicle ownership in the United Kingdom, affecting millions of drivers. With recent changes and updates in regulations, understanding DVLA tax is essential for compliance and financial planning for vehicle owners. This article explores the latest developments in DVLA tax policies and their potential impacts.

What is DVLA Tax?

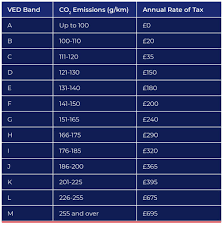

DVLA tax, commonly known as Vehicle Excise Duty (VED), is a tax payable for using a vehicle on public roads in the UK. It serves not only as government revenue but also as a measure to encourage drivers to adopt environmentally friendly practices, as rates are structured based on CO2 emissions. The DVLA manages the collection of this tax and ensures that vehicle owners are compliant with legal requirements.

Recent Changes in DVLA Tax Regulations

As of October 2023, the DVLA has instituted several changes to tax regulations that vehicle owners should be aware of. One significant update is the adjustment of VED rates, which have increased across various vehicle categories. Additionally, the new ‘clean air’ tax bands introduced last year are now in full effect, incentivising the use of electric and hybrid vehicles by considerably lowering their tax liabilities.

For instance, electric vehicles (EVs) are currently exempt from VED altogether, while hybrids with lower emissions benefit from reduced rates. This shift aligns with the UK government’s broader goal of reducing carbon emissions and promoting sustainable transport. The DVLA has also implemented a more streamlined online system for vehicle owners to pay their tax and manage their accounts, reflecting a move towards digitisation in public services.

Implications for Vehicle Owners

The changes in DVLA tax regulations have several implications for vehicle owners. Firstly, those who own older, high-emission vehicles may face increased financial burdens due to higher tax rates. Conversely, those transitioning to electric or low-emission vehicles stand to benefit significantly from reduced or zero tax costs. It is crucial for owners to stay informed about these changes to make financially sound decisions regarding their vehicles.

Conclusion

As DVLA tax regulations evolve, vehicle owners must remain vigilant and proactive in understanding their tax obligations. The recent updates highlight the government’s commitment to environmental sustainability while still ensuring necessary revenue collection for road maintenance and safety. As the shift towards electric vehicles continues, it is likely that DVLA tax policies will further adapt, encouraging more drivers to choose eco-friendly options. Staying updated on DVLA tax will not only help vehicle owners comply with regulations but may also lead to significant savings in the long run.

You may also like

Recent Developments Involving Jacob Rees-Mogg

How to Tackle Rising Energy Bills in 2023