Introduction: The Significance of Mortgages

Mortgages are a critical component of the housing market, enabling millions to purchase homes and invest in property. As lending rates and economic conditions fluctuate, understanding mortgages becomes essential for potential homeowners. This comprehension not only aids individuals in navigating the purchasing process but also highlights broader economic trends affecting the real estate market.

Current State of the Mortgage Market

As of late 2023, the UK mortgage market has been experiencing notable changes. According to the Bank of England, interest rates have seen an uptick, reaching their highest levels since 2008. This shift directly impacts mortgage affordability, as first-time buyers face increased costs. The average two-year fixed rate mortgage is reported to be around 5.5%, marking a significant rise compared to previous years when rates were notably lower.

Types of Mortgages Available

There are several types of mortgages available to potential homeowners, each serving different financial circumstances. The most common types include:

- Fixed-Rate Mortgages: These allow borrowers to lock in a specific interest rate for a predetermined period.

- Variable Rate Mortgages: These offer interest rates that fluctuate, potentially leading to lower initial payments but increased risk.

- Help to Buy Mortgages: Government initiatives designed to assist first-time buyers in getting onto the property ladder.

In addition to these, lenders are increasingly offering flexible terms and conditions to adapt to potential buyers’ needs, especially as economic conditions evolve.

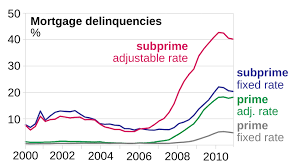

The Impact of Economic Factors

The recent rise in inflation and the Bank of England’s response through interest rate adjustments have significant implications for mortgages. Rising rates can lead to higher monthly payments, impacting buyers’ ability to secure financing. Additionally, potential homebuyers are becoming more cautious, weighing the risks versus the benefits of entering the market in an inflationary environment.

Conclusion: The Future of Mortgages

Looking ahead, the mortgage landscape in the UK is expected to continue evolving. With inflationary pressures potentially stabilising, interest rates may level off; however, predictions remain uncertain. For potential homeowners, it is essential to remain informed about market trends and seek professional advice when considering mortgage options. Ultimately, navigating the complexities of mortgages is not only vital for individual financial health but also for the overall stability and growth of the housing market.

You may also like

The Importance of Credit Cards in Today’s Financial Landscape

Understanding Loans: Impact and Importance in Today’s Economy