Introduction to the State Pension

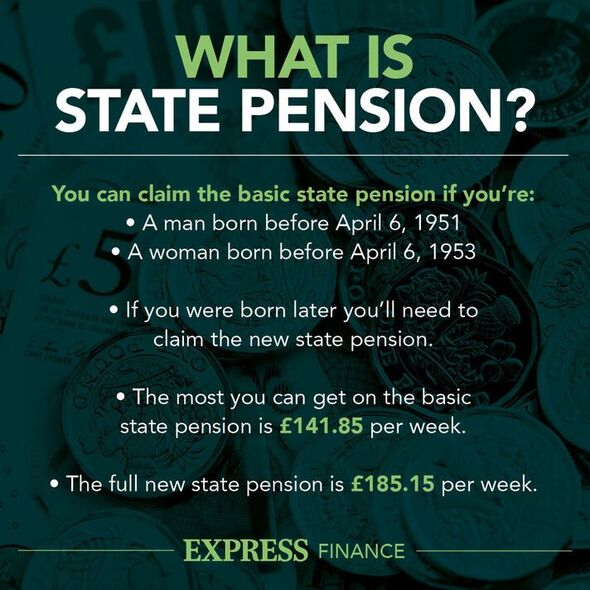

The state pension is a critical component of the UK’s welfare system, providing financial support to retirees. As the population ages and more individuals reach retirement age, understanding the state pension becomes increasingly relevant. It serves as a safety net for millions, helping to alleviate poverty and ensure a basic standard of living in later life.

Current State Pension System

As of April 2023, the full new state pension for those reaching state pension age after 6 April 2016 is £203.85 per week. It is important to note that the amount one receives is based on National Insurance contributions. To qualify for the full amount, individuals need to have made contributions for at least 35 years, while those with fewer than 10 years’ contributions are not entitled to any pension at all.

Updates and Changes

The state pension age has also been a topic of considerable discussion. Currently, the state pension age is set to rise, with women born on or after 6 April 1953 and men born on or after 6 April 1951 facing a gradual increase. This is part of an ongoing reform aimed at ensuring the sustainability of pension payouts in the face of longevity trends and rising life expectancy. Consequently, the state pension age will reach 67 by 2028, and further discussions about increasing it to 68 are anticipated.

Financial Planning for Retirement

With the ever-changing landscape of pensions, it is crucial for current and future retirees to proactively plan their financial futures. Many financial experts recommend supplementing the state pension with private savings or workplace pensions to ensure a comfortable retirement. The importance of starting early and seeking the advice of financial advisors cannot be overstated, especially as individuals face uncertainties regarding future government policies.

Conclusion

The state pension remains a vital support system for retirees in the UK. However, ongoing changes to eligibility and age requirements highlight the need for individuals to take responsibility for their financial fitness. As one navigates towards retirement, understanding how the state pension fits into the larger financial picture can help secure a more stable and fulfilling retirement. Keeping informed about changes in legislation and actively engaging with one’s pension plan is essential for financial well-being.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price