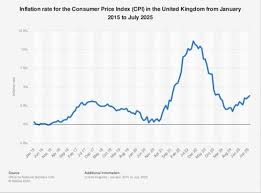

The Importance of CPI Inflation Rate

The Consumer Price Index (CPI) inflation rate serves as a crucial indicator of the economic health of a nation. It measures the average change over time in the prices paid by consumers for goods and services and provides insight into the cost of living. Monitoring the CPI inflation rate is essential for policymakers, businesses, and consumers as it influences interest rates, wage negotiations, and investment decisions.

Current Trends in the CPI Inflation Rate

As of October 2023, the UK CPI inflation rate stands at 6.5%, showing a significant drop from the peak of 11.1% seen in October 2022. This decline can largely be attributed to decreasing energy prices and improved supply chain dynamics which have stabilised the market. Food inflation continues to remain a concern, albeit at a slight reduction to around 9.4%, demonstrating the ongoing challenges faced by consumers in managing household budgets.

Key Factors Influencing Inflation

Several factors have contributed to the current inflation rate. Government interventions, such as energy subsidies and fiscal measures aimed at assisting households, have played a vital role in curbing inflation. Furthermore, the Bank of England’s monetary policy strategies, including adjustments in interest rates, remain crucial in steering the economic landscape. Recent hikes in interest rates to 5.25% are part of efforts to further control inflation and bring it down to the target of 2% over the medium term.

The Impact on Businesses and Consumers

The elevation in inflation rates impacts purchasing power, influencing consumer behaviour and spending patterns. With prices rising more slowly, customers may begin to feel some relief; however, the persistent cost of essential goods signifies that economic recovery is not yet complete. Businesses are also responding by adjusting prices and exploring ways to manage costs without alienating their customers, indicating a phase of recalibration in the market.

Conclusion and Future Predictions

Looking forward, the CPI inflation rate will continue to be a focal point for economic discussions. Analysts project that inflation may continue to decline steadily in the upcoming months but caution that external factors like geopolitical tensions or further supply chain disruptions could hinder progress. For readers, understanding these dynamics is essential as they influence everything from personal finances to broader economic policies. Keeping abreast of CPI movements will be crucial for making informed decisions in the current economic climate.

You may also like

The Dynamics of Price in the Modern Economy

The Importance and Relevance of MFC in Modern Development

Current Status of the Bank of England Base Rate

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial