Understanding the Mansion Tax in the UK: Current Developments

Introduction to Mansion Tax

The debate surrounding the mansion tax in the United Kingdom has resurfaced as housing prices continue to soar and economic challenges mount. Recently, various political parties have brought the concept back into the spotlight, arguing that such a tax could provide essential funding for public services while targeting wealthier property owners. Understanding the implications of this proposed tax is crucial for both homeowners and the wider population.

What is Mansion Tax?

The mansion tax typically refers to a levy imposed on properties valued above a certain threshold. Advocates argue that it should be applied to high-value homes—often defined as properties worth £2 million or more. The revenue generated from this tax could be allocated to vital public services, such as healthcare and education, which have faced severe budget constraints in recent years.

Recent Developments

In the wake of the 2023 general election, both Labour and the Liberal Democrats have taken steps to incorporate the mansion tax into their manifestos. They contend that as housing prices have risen dramatically in the last decade, the wealthiest homeowners should contribute more through taxation. Yet, the Conservative Party has firmly opposed the idea, arguing that it could discourage investment in the housing market and destabilise high-end property sales.

According to the UK House Price Index, property values in London have dramatically outpaced those in the rest of the country, leaving many feeling the pinch despite the rising tide of prices. Proponents of the mansion tax assert that most citizens would not be adversely affected, as only a small percentage of homes would fall under the proposed tax rate.

Public Opinion

Surveys indicate that public opinion is split on the mansion tax. In a recent poll by YouGov, approximately 45% of respondents supported the idea, believing that wealthier homeowners should contribute more to the society that supports them. Conversely, critics of the tax state it could disproportionately target certain demographics, particularly in London, where high property values may not necessarily reflect a homeowner’s overall wealth or liquidity.

Conclusion: The Future of Mansion Tax in the UK

The future of the mansion tax remains uncertain as debates continue within the political landscape. While it has the potential to raise crucial revenue for public services, opposition from various stakeholders, especially property developers and Conservative politicians, could complicate its implementation. As housing prices rise and economic pressures grow, the mansion tax may return to forefront discussions, urging both policymakers and citizens to reconsider the implications of wealth distribution in an increasingly unequal society.

You may also like

Understanding Tax: Its Importance and Recent Changes

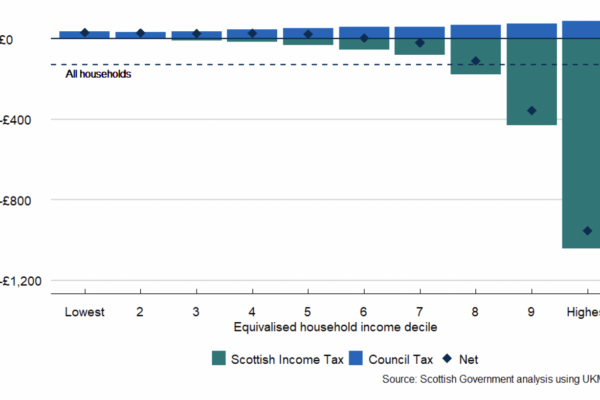

Overview of Scottish Budget Income Tax Changes in 2023