Introduction

The Federal Reserve’s interest rate decisions play a crucial role in shaping the United States economy. Recently, the topic of Fed rate cuts has gained prominence amid concerns surrounding inflation and economic growth. These cuts can influence borrowing costs, consumer spending, and overall economic stability, making it essential for citizens and investors alike to understand their significance.

Current Context of Fed Rate Cuts

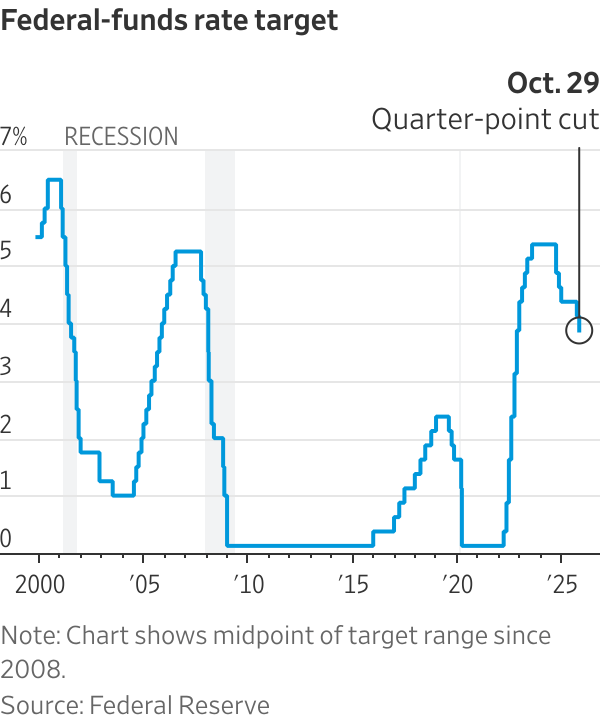

In September 2023, the Federal Reserve opted to maintain its current interest rates, a level they have held steady since earlier attempts to combat persistently high inflation. However, market analysts suggest that potential Fed rate cuts might be on the horizon if inflation continues to stabilise and if the economy shows signs of slowing down.

The Fed’s dual mandate of maximising employment and stabilising prices means that decisions regarding interest rates are closely monitored by economists and policymakers. Many experts believe that rate cuts could become a reality as the central bank evaluates economic indicators and aims to stimulate growth, particularly in the face of a potential recession. Recent economic data, including decreased consumer spending and increased unemployment claims, have led to speculation about the timing and magnitude of future rate cuts.

Impact on Consumers and Businesses

When the Fed lowers interest rates, it usually results in cheaper loans and mortgages. This could encourage consumers to increase spending and investment, ultimately stimulating economic growth. Businesses often take advantage of lower rates to finance expansion projects or manage existing debt. In turn, a surge in investment can lead to job creation and improved economic conditions.

However, lower interest rates can have mixed effects. While they benefit borrowers, they can disadvantage savers earning less interest on savings accounts and fixed-income investments. Additionally, prolonged periods of low rates can lead to excessive borrowing and contribute to asset bubbles, posing risks to financial stability if not managed prudently.

Conclusion

The anticipated Fed rate cuts could have significant implications for both the economy and individual finances. Analysts project that if these cuts occur, they may stimulate spending and investment, easing the impact of an economic slowdown. However, the potential risks must be considered, as easier monetary policy can lead to unintended economic consequences. For consumers and investors, staying informed about the Fed’s decisions and monitoring economic indicators will be crucial in navigating the evolving financial landscape.

You may also like

The Dynamics of Price in the Modern Economy

The Importance and Relevance of MFC in Modern Development

Current Status of the Bank of England Base Rate

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial