Introduction: The Nikkei 225’s Significance

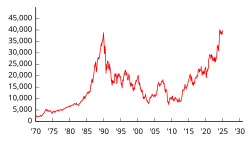

The Nikkei 225, often referred to simply as the Nikkei, is one of the most prominent stock market indices in Japan, reflecting the performance of the top 225 companies listed on the Tokyo Stock Exchange. As a barometer of Japan’s economic health, the Nikkei 225 provides investors with crucial insights into market trends and the overall financial sentiment in the Asia-Pacific region. Its fluctuations are closely monitored not just by Japanese investors but also by global market participants looking for indicators of potential economic shifts.

Current Performance of the Nikkei 225

As of mid-October 2023, the Nikkei 225 has seen a notable increase of approximately 12% year-to-date, driven largely by robust corporate earnings and a positive outlook for Japan’s economic recovery post-COVID-19. Analysts have pointed out that the index’s upward momentum has been supported by several large-cap stocks such as Toyota, Sony, and SoftBank, which have consistently reported strong financial results.

Recent developments, including policy measures from the Bank of Japan aiming to stabilise inflation and support economic growth, have also boosted investor confidence. The country’s commitment to remain flexible with its monetary policy is seen as a positive indicator for market resilience.

Market Sentiment and Global Influences

Investor sentiment surrounding the Nikkei 225 has been bolstered by global trends such as the recovery in the technology sector and increasing foreign investments in Japanese markets. Additionally, Japan’s easing of travel restrictions has led to a rebound in sectors that were heavily hit during the pandemic, including tourism and hospitality, contributing positively to the overall index performance.

However, challenges remain on the horizon. Concerns over inflation levels and the impact of global interest rate hikes could create volatility in the markets. Analysts predict that while the Nikkei 225 may continue to rise, it should be viewed with caution amidst these potential headwinds.

Conclusion: Future Outlook for the Nikkei 225

The outlook for the Nikkei 225 remains cautiously optimistic as the index adapts to ongoing economic shifts both domestically and globally. Investors are encouraged to keep an eye on key indicators, including corporate earnings reports and central bank policies. As Japan continues to navigate its post-pandemic recovery, the Nikkei 225 will undoubtedly be a critical indicator of both local and international market dynamics. The potential for growth is substantial, but so too are the risks, making it essential for investors to stay informed and vigilant.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial