Introduction

The Scottish budget for 2023 has introduced significant changes to income tax that affect millions of residents. These adjustments come at a crucial time as the government seeks to balance financial pressures stemming from inflation and economic recovery post-COVID-19. Understanding these changes is essential for taxpayers and businesses alike, as they have direct implications on disposable income and economic activity across Scotland.

Details of the Income Tax Changes

The recent budget announcement has outlined adjustments to income tax thresholds and rates aimed at raising additional revenue while also providing some relief to lower-income earners. One of the key changes is the increase in the higher rate tax threshold from £43,662 to £45,000, which allows more earners to retain a greater portion of their income under the lower taxation bracket.

Additionally, the basic rate of income tax has remained unchanged at 20%, whereas the top rate of 41% will continue to apply to earnings over £45,000. However, the Scottish government has also introduced a new tax band for individuals earning between £50,000 and £100,000, which signifies a further financial burden on upper-middle-class earners. This shift aims to address income disparity and increase funding for public services.

Implications for Taxpayers

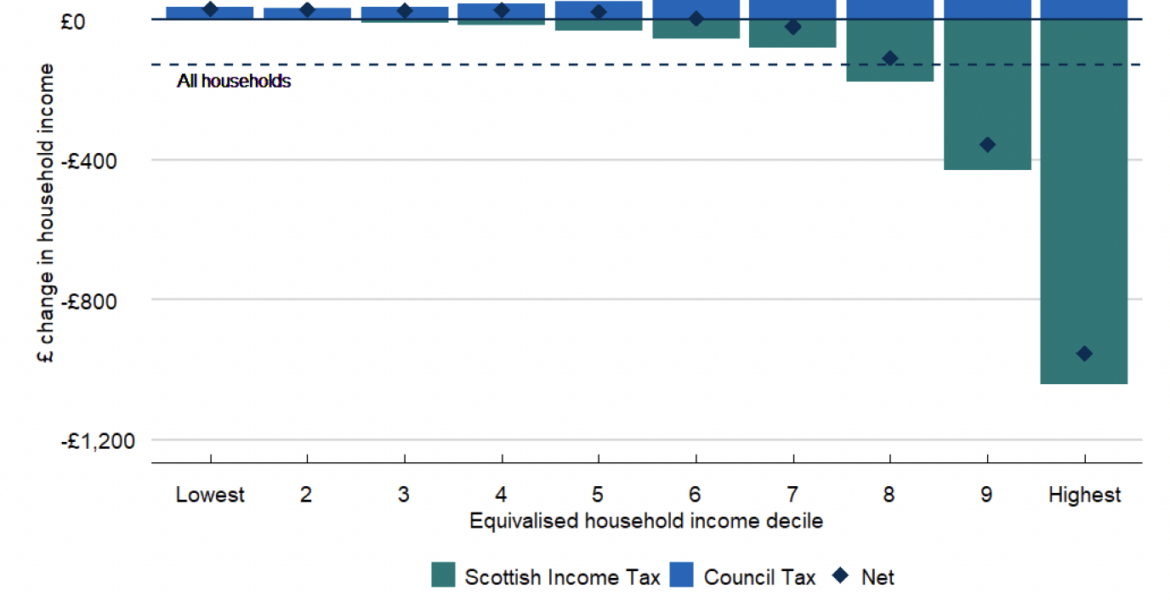

The implications of these changes for taxpayers could be profound. For higher earners, the new tax structure means potential increases in tax liabilities, impacting their overall income after taxation. On the other hand, lower-income households may benefit from these shifts in thresholds, gaining some relief in their financial responsibilities.

Economists predict that while these changes may generate additional revenue for the Scottish Government, they could also lead to mixed reactions from the business community. Employers may face decisions on how to manage wage structures in light of increased taxation costs.

Conclusion

In conclusion, the Scottish budget income tax changes reflect a balancing act by the Scottish Government in addressing budgetary needs while also attempting to accommodate the financial stress faced by many citizens. Moving forward, the success of these tax reforms will depend on how well the government manages to translate increased revenue into tangible benefits for public services and economic growth. Taxpayers must stay informed about these developments as they navigate the evolving landscape of personal finance in Scotland.

You may also like

Michael Carrick: The Rise of a New Manager in Football

Exploring East Grinstead: History and Attractions