Introduction

Experian is one of the largest credit reporting agencies globally, playing a crucial role in the financial ecosystem. As consumers increasingly rely on credit for purchases, understanding how Experian operates and its significance in credit management is vital.

What is Experian?

Founded in 1996 and headquartered in Dublin, Ireland, Experian focuses on providing data and analytical tools to clients looking to understand and manage their credit risk. The company’s core services include credit reporting, credit scoring, marketing services, and fraud detection, impacting individuals’ ability to secure loans and financial products.

Recent Developments

In September 2023, Experian announced the rollout of a new feature called “CreditLook”, which allows consumers to monitor their credit scores in real time. This initiative aims to empower users to take charge of their financial health by providing immediate access to their credit data. Additionally, Experian has partnered with various financial institutions to enhance data-sharing capabilities, thereby improving credit assessment processes.

Furthermore, Experian has been actively involved in promoting financial literacy through its community outreach programs, offering educational resources to help individuals understand the importance of maintaining a healthy credit score.

The Importance of Credit Reporting

Experian’s role in credit reporting is critical for consumers and businesses alike. Credit scores heavily influence loan approvals, interest rates, and insurance policies. A high credit score, often influenced significantly by data from Experian, can enable consumers to access lower interest rates on loans, thereby saving them money over time.

Moreover, lenders use this data to assess the likelihood of a borrower defaulting on a loan. With the recent updates in credit scoring models, Experian now incorporates more variables into its assessments, potentially giving a more accurate picture of an individual’s creditworthiness.

Conclusion

As the economy continues to evolve, the significance of credit reporting agencies like Experian cannot be overstated. Their services enhance consumer transparency and promote responsible financial behaviour. Understanding Experian’s functions and the implications of credit scoring is essential for individuals navigating their financial journeys. By embracing tools and resources provided by companies like Experian, consumers can improve their credit standing and make informed financial decisions in the future.

You may also like

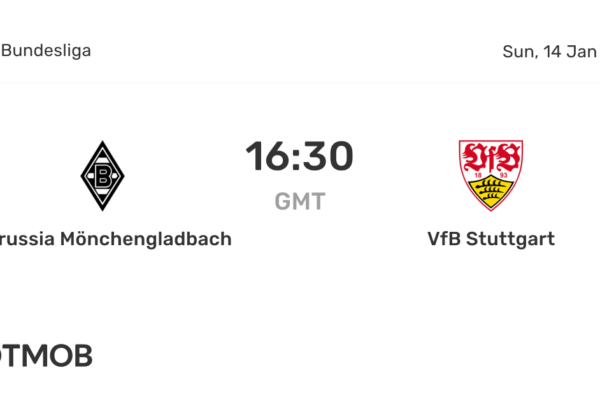

Mönchengladbach vs VfB Stuttgart: A Match to Remember

James Bree: The Promising Journey of a Young Football Star