Introduction

Monitoring share prices is crucial for investors, analysts, and anyone interested in financial markets. Babcock International Group, a leading engineering services provider in the UK, has garnered attention due to its fluctuating share price, especially in recent months. With its primary focus on defence and infrastructure sectors, understanding the dynamics of Babcock’s share price is vital for stakeholders and potential investors alike.

Current Trends in Babcock Share Price

As of late October 2023, Babcock’s share price has seen significant volatility, dropping approximately 12% over the last month. The share price is currently hovering around £3.00. Market analysts attribute this downturn to a combination of factors, including operational challenges and changes in government spending in defence contracts. Additionally, pressing concerns about rising costs and supply chain disruptions have made investors cautious.

Recent Events Influencing Share Performance

Babcock reported its half-year results recently, revealing a 20% decline in operating profit compared to the previous year. This news sent ripples through the stock market, as investors reacted to the company’s lowered guidance for the remainder of the fiscal year. Moreover, a strategic review initiated by the new CEO is aimed at addressing operational inefficiencies, but the uncertainty surrounding this transition has also impacted investor confidence.

The prevailing geopolitical tensions have further complicated the situation. The ongoing conflict in Ukraine has prompted many nations to reevaluate their defence budgets, thus affecting companies like Babcock. An increasing number of investors and analysts are closely monitoring government policies and contracts to assess potential impacts on future earnings.

Future Outlook and Significance

Looking ahead, analysts suggest that Babcock’s share price may remain under pressure in the short term, largely due to ongoing operational restructuring and external uncertainties. However, there are proponents who believe that long-term prospects could improve if the company successfully implements its strategic changes and manages to secure new government contracts.

For current shareholders, these developments raise critical questions regarding the viability of holding onto their investments in the near term. As the market continues to be influenced by external factors and company performance, remaining informed about Babcock’s financial health and industry position is paramount for making informed investment decisions.

Conclusion

In conclusion, the Babcock share price reflects a complex interplay of company-specific challenges and broader economic conditions. Understanding these factors is essential for investors looking to navigate the risks and opportunities associated with one of the UK’s key engineering firms. As the situation evolves, keeping an eye on Babcock’s strategic updates and market performance will be crucial for those invested in or contemplating engagement with the company’s shares.

You may also like

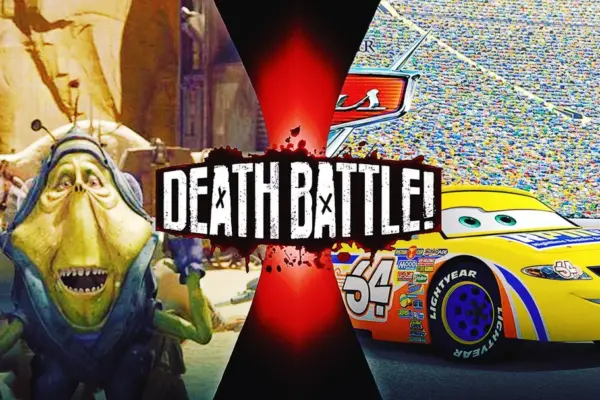

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football