Introduction

The European Financial Community (EFC) plays a pivotal role in shaping the financial landscape within Europe and beyond. It encompasses various institutions, regulations, and practices that influence economic stability and growth in the region. As Europe continues to navigate the complexities of post-pandemic recovery, understanding the EFC’s operations and its relevance becomes increasingly significant.

The Structure of the EFC

The EFC comprises a network of financial institutions, including banks, investment firms, and insurance companies, all working together under the guidance of European financial regulations. Key bodies such as the European Central Bank (ECB), the European Banking Authority (EBA), and the European Securities and Markets Authority (ESMA) govern the community, ensuring compliance and stability in the financial markets.

Recent Developments in the EFC

In recent months, the EFC has faced numerous challenges, including inflationary pressures and rising interest rates, which have compelled financial institutions to adjust their strategies. Notably, the ECB has been actively implementing measures to curb inflation, which has sparked debates about the balance between economic growth and price stability.

Additionally, the EFC has been focusing on digital transformation, with an increased emphasis on fintech innovations and sustainable finance. The push for greener investments has led to initiatives aimed at promoting environmentally responsible financial practices, aligning with the EU’s climate goals.

The Importance of the EFC

The EFC’s influence extends beyond Europe, impacting global financial systems. As the EU remains a significant player in international trade and finance, developments within the EFC can have worldwide repercussions. For instance, changes in interest rates or regulatory approaches can affect foreign investments, exchange rates, and economic relations with non-EU countries.

Conclusion

As the EFC continues to evolve in response to current economic challenges and technological advancements, its role in shaping the future of finance cannot be underestimated. Stakeholders, including policymakers, businesses, and investors, must remain vigilant and informed about the ongoing changes within the community. Monitoring these developments will be crucial for anticipating future trends and making strategic financial decisions.

You may also like

The Story of Larry the Cat: Feline Guardian of 10 Downing Street

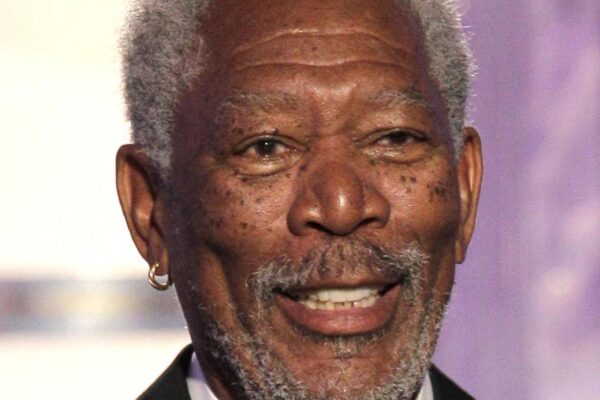

The Legendary Morgan Freeman: A Journey Through His Career

The Journey of Millie Court from Love Island

SEARCH

LAST NEWS

- The Story of Larry the Cat: Feline Guardian of 10 Downing Street

- The Legendary Morgan Freeman: A Journey Through His Career

- The Journey of Millie Court from Love Island

- The Rise of Blockchain Applications in Modern Industries

- Upcoming Celtic Fixtures for 2026: What to Expect