The Importance of the State Pension

The state pension is a vital financial support system for older individuals in the UK, providing a crucial income for those who have reached retirement age. With an increasing number of people living longer, understanding how the state pension works and any recent changes is more important than ever.

Current State Pension Statistics

As of the latest updates in 2023, the full new state pension is £203.85 per week, an increase from the previous year, reflecting the government’s annual adjustment in line with inflation and average wages, known as the triple lock policy. This policy has been a hot topic of discussion among policymakers, especially in light of ongoing economic challenges.

Recent Changes and Announcements

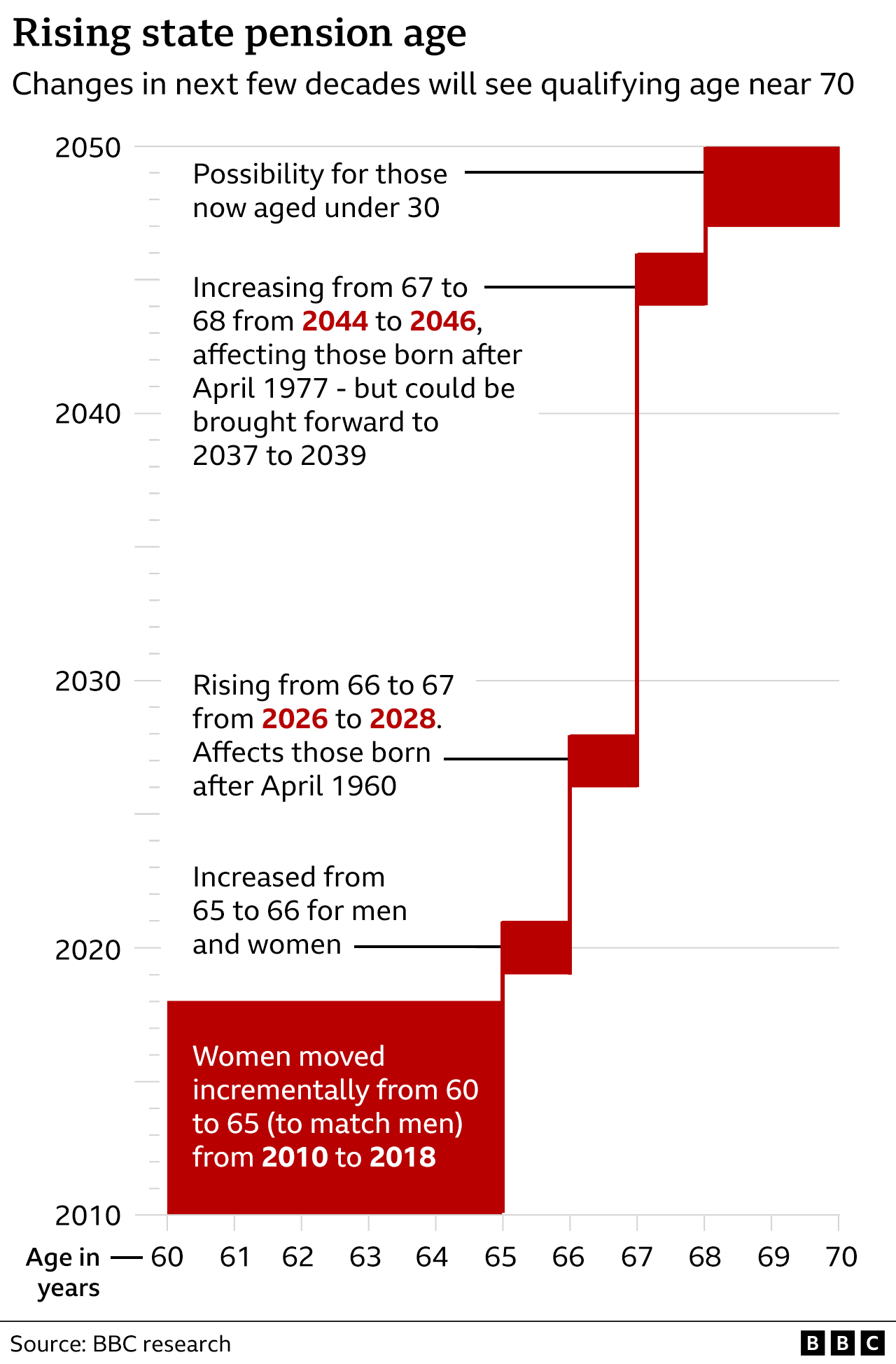

In recent months, the government has been under pressure to reassess the state pension age, which is currently set at 66 for both men and women. With life expectancy rates increasing, discussions surrounding raising the state pension age to 67 have intensified. Such changes could significantly affect those planning for their retirement, leading to uncertainty in financial planning for many.

Additionally, the government has also proposed a review into the possibility of introducing a ‘pension credit’ scheme, designed to support the most vulnerable pensioners, ensuring they receive a minimum level of income. This proposal, if passed, could have a profound impact on low-income pensioners.

The Importance of Planning for Retirement

While the state pension serves as a foundational income for many, experts recommend that individuals also invest in private pensions or savings plans to ensure a comfortable retirement. Given the fluctuations and potential reforms within the state pension system, diversifying retirement income has become even more crucial.

Conclusion

The state pension remains a critical lifeline for countless individuals in the UK, but the evolving landscape necessitates awareness and proactive planning. As discussions continue regarding pension ages, potential benefits for low-income retirees, and the implications of economic pressures, it’s essential for individuals to stay informed. By planning ahead, Britons can better navigate the complexities of retirement to secure their financial future.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price