Introduction

The Federal Open Market Committee (FOMC) plays a critical role in shaping the economic landscape of the United States. As the monetary policymaking body of the Federal Reserve System, the FOMC is responsible for setting interest rates and guiding the country’s monetary policy. Given its influence over economic conditions, the decisions made during FOMC meetings are closely monitored by economists, financial institutions, and investors alike.

Recent Developments

On September 20, 2023, the FOMC convened for its latest meeting, determining the course of interest rates amid evolving economic indicators. Following a period of aggressive rate hikes to combat inflation, the Committee decided to hold the federal funds rate steady at 5.25% to 5.50%. This decision reflects recent data suggesting that inflation has moderated, while still showing signs of resilience in the job market.

Many experts view this meeting as a pivotal moment in monetary policy, as it sets the stage for future actions. Analysts are divided on whether the FOMC will implement further rate changes in the coming months, with some anticipating another hike in response to persistent inflationary pressures, whereas others argue for a continued patient approach to assess ongoing economic trends.

The Implications for the Economy

The FOMC’s decisions have far-reaching implications for the economy. When interest rates increase, borrowing costs rise, which can dampen consumer spending and business investments, potentially slowing economic growth. Conversely, maintaining rates can stimulate economic activity by encouraging borrowing and spending.

The communications from FOMC members also play a critical role in market sentiment. For instance, indications from Chair Jerome Powell during the September meeting hinted at a cautious but optimistic outlook, suggesting vigilant monitoring of economic indicators before any decisive moves. This measured approach is designed to balance inflation concerns while also nurturing economic growth.

Conclusion

In conclusion, the FOMC remains a key player in navigating the complexities of the U.S. economy as it attempts to stabilize inflation without hampering growth. As discussions regarding future rate adjustments continue, market participants will be keenly observing economic indicators and FOMC communications. The outcomes of these deliberations will not only impact the U.S. financial landscape but may also reverberate across global markets, highlighting the enduring significance of the FOMC’s influence.

You may also like

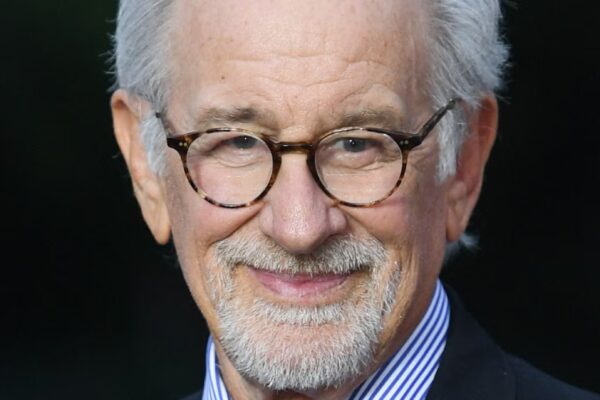

The Extraordinary Journey of Steven Spielberg

Exploring the Rise of Online Betting in 2023