Introduction

The exchange rate between the British pound and the euro is a crucial indicator of economic health and influences a wide range of financial transactions, including trade and investment within Europe. As the UK navigates its post-Brexit economic landscape and global inflation trends, understanding the forecast for this currency pair becomes essential for businesses, investors, and travellers alike.

Current Exchange Rate Overview

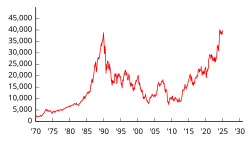

As of October 2023, the exchange rate for the pound to euro has seen significant fluctuations due to various economic factors. Currently, the pound stands at around €1.16, reflecting ongoing market volatility. Analysts highlight that the Bank of England’s monetary policy, inflation rates, and economic growth indicators will play pivotal roles in shaping future movements of the pound against the euro.

Factors Influencing the Forecast

Several key factors are likely to impact the exchange rate in the coming months:

- Monetary Policy Decisions: The Bank of England’s stance on interest rates will directly influence the strength of the pound. If the bank opts to raise rates to combat inflation, it may bolster the currency’s value against the euro.

- Economic Performance: Recent GDP growth figures in the UK have shown modest recovery, but ongoing challenges such as supply chain disruptions and labour shortages remain. In contrast, the Eurozone’s economic indicators suggest a cautious but steady recovery, which could affect investors’ confidence and trading perspectives.

- Geopolitical Events: The uncertainty surrounding issues such as trade agreements and political stability in both the UK and EU will add further complexity to exchange rate predictions. For example, any negative news regarding Brexit negotiations could exert downward pressure on the pound.

Expert Predictions and Outlook

Financial experts have provided various forecasts regarding the pound to euro exchange rate for the latter part of 2023. Expectations vary, with some analysts predicting a potential rise towards €1.20 if the UK economy demonstrates stronger-than-anticipated resilience, while others warn that sluggish growth could push the rate down to €1.10. According to a consensus forecast from several financial institutions, the pound may stabilise around €1.15 to €1.17 for the foreseeable future.

Conclusion

In summary, the forecast for the pound to euro exchange rate remains highly contingent on a mix of economic performance, monetary policy decisions, and geopolitical developments. For businesses and individuals engaged in currency exchanges, staying informed about these factors will be crucial in navigating future fluctuations. While the uncertainty is apparent, being proactive and seeking expert analysis will help mitigate risks associated with currency exchange.

You may also like

Current Landscape of Crypto News: What You Need to Know

The Importance and Current Trends of the Nikkei 225 Index

Forecasting PIP Rates for 2026: Trends and Implications

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial