Introduction

Understanding mortgage rates today is crucial for homebuyers and homeowners looking to refinance. With fluctuating interest rates heavily influencing monthly payments, staying informed about the current trends is essential. As the housing market continues to evolve, observing these rates can help buyers make informed decisions.

Current Trends in Mortgage Rates

As of October 2023, mortgage rates have shown a slight increase compared to the same period last year. According to data from the Bank of England, the average rate for a 30-year fixed mortgage has reached around 6.5%. This rise is attributed to multiple factors, including inflationary pressures and actions by the central bank to manage economic stability. Recent economic indicators, including a dip in unemployment rates and moderate wage growth, have also influenced lending changes.

Variable and Fixed Rates Explained

Today’s mortgage offerings can broadly be categorised into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide a stable payment schedule, appealing to first-time buyers keen on budgeting. Conversely, variable-rate mortgages often start with lower rates but can fluctuate with market conditions, making them potentially riskier over time.

Impact on Homebuyers

The increase in mortgage rates is having a tangible impact on homebuyers. According to a recent survey from the UK Finance Association, rising interest rates are discouraging some potential buyers, resulting in fewer transactions in an already competitive market. Meanwhile, existing homeowners are also feeling the pressure as many consider refinancing their current loans to take advantage of lower rates that were previously available.

Conclusion

In conclusion, understanding mortgage rates today is vital for anyone involved in the housing market. As rates fluctuate, potential homebuyers and those looking to refinance must closely monitor these changes to navigate their options effectively. Analysts predict that as the economy stabilises, rates may eventually plateau, but in the short term, buyers should brace for further potential increases. For those considering a property purchase, acting sooner rather than later might yield better financial positioning in the long run.

You may also like

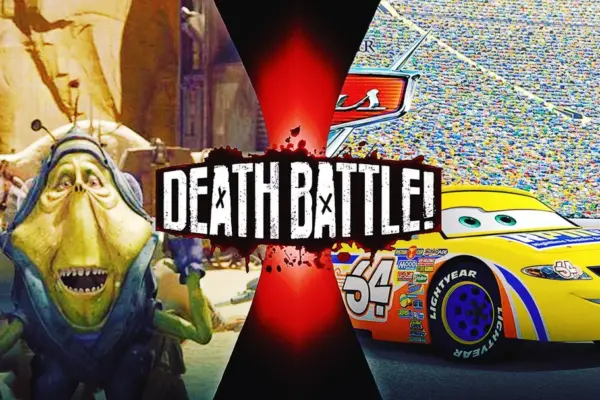

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football