Introduction

In recent years, the phenomenon of billion-dollar startups has captured the attention of investors, entrepreneurs, and the public alike. These companies, often referred to as “unicorns,” are defined by their valuation exceeding one billion dollars. The growing number of such startups signifies a shift in the business landscape, driving innovation and contributing significantly to economic growth.

Increasing Numbers of Unicorns

A report from CB Insights revealed that as of September 2023, there are over 1,200 unicorns worldwide, with a cumulative valuation exceeding $4 trillion. This growth has been fuelled by the tech sector, with software, fintech, and health tech leading the way. Notable entrants to the billion-dollar club include companies such as Stripe, SpaceX, and DoorDash, which have innovated in their respective fields and captured the imagination of consumers and investors alike.

The Role of Venture Capital

Venture capital has played a critical role in propelling these startups to billion-dollar valuations. In 2022 alone, global venture capital investments reached a record high of $300 billion, with the majority funnelled into tech-focused industries. This influx of capital enables startups to scale rapidly, invest in research and development, and expand their market reach. Furthermore, competitive investor environments have led to skyrocketing valuations, illustrating the hunger for innovation in today’s economy.

Challenges and Sustainability

However, the rise of billion-dollar startups is not without its challenges. Many of these companies face scrutiny regarding their long-term sustainability, business models, and profitability. Despite their high valuations, several unicorns have struggled to maintain growth and secure a path to profitability. This has led to a more cautious approach from investors, as seen in the significant drop in venture capital funding in late 2022 and early 2023. Additionally, economic factors such as inflation and recession fears could impact the future growth of these startups.

Conclusion

The trend of billion-dollar startups highlights a dynamic shift in the global economy, showcasing the potential for innovation and disruption. While the rise of unicorns presents exciting opportunities for investors and entrepreneurs, it also raises questions about sustainability and long-term success. As we look towards the future, it remains to be seen how these billion-dollar enterprises will adapt to new market challenges and continue to influence the economic landscape.

You may also like

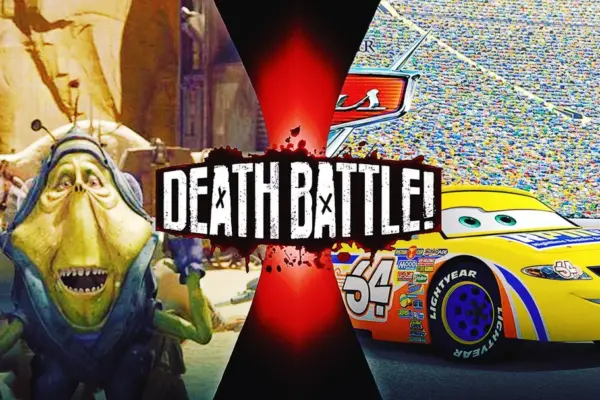

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football