Introduction

The share price of HSBC Holdings plc, one of the world’s largest banking and financial services organisations, is a significant barometer of economic health. As a global bank operating predominantly in Europe and Asia, fluctuations in its share price often reflect broader market trends and investor sentiment. Recent events have sparked considerable interest as investors look for insights into the bank’s performance against a backdrop of changing financial landscapes.

Recent Developments

As of October 2023, HSBC’s share price has been experiencing notable volatility due to various factors, including interest rate changes, geopolitical tensions, and the evolving landscape of global finance. Recently, the bank reported third-quarter earnings that exceeded analysts’ expectations, with net profit rising 12% year-on-year, which positively impacted its share price.

Market analysts highlight that HSBC’s strategic focus on Asia, particularly China, is a key driver behind its resilience. The bank’s efforts to strengthen its position in the Asian markets and its recent moves to simplify operations and reduce costs are likely to keep investor interest alive. In the past week, the share price reached a peak of £5.05 after news of increased dividends and improved guidance for the next financial year.

Market Sentiment and Predictions

Despite the positive earnings report, analysts remain cautious due to potential economic headwinds, including rising inflation and regulatory scrutiny in various jurisdictions. Some experts predict that HSBC’s share price could fluctuate between £4.80 and £5.20 in the coming weeks as the market reacts to economic indicators and Central Bank policies.

Furthermore, the ongoing tension between the US and China may pose risks, as escalating tariffs or sanctions could impact HSBC’s operations. Investors are closely monitoring these geopolitical developments, which could lead to significant shifts in share price based on investor confidence and risk appetite.

Conclusion

<pIn summary, HSBC's share price remains a critical topic of interest for investors, reflecting both the bank's strong performance amid challenging conditions and the broader economic environment. While the recent earnings report has provided some optimism, ongoing geopolitical tensions and market uncertainties could lead to further volatility. Investors should stay informed about both financial indicators and external market forces that may influence the trading of HSBC shares in the future.

You may also like

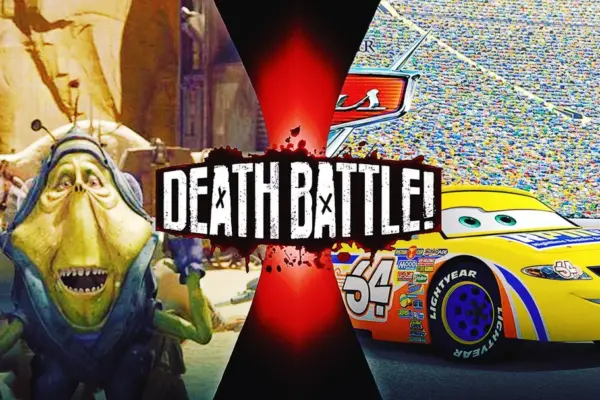

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football