Introduction

The share price of Alphabet Inc., the parent company of Google, serves as a key indicator not only of the company’s financial health but also of broader trends within the technology sector. As investors navigate a fluctuating market, understanding the factors influencing Alphabet’s share price is critical.

Recent Performance

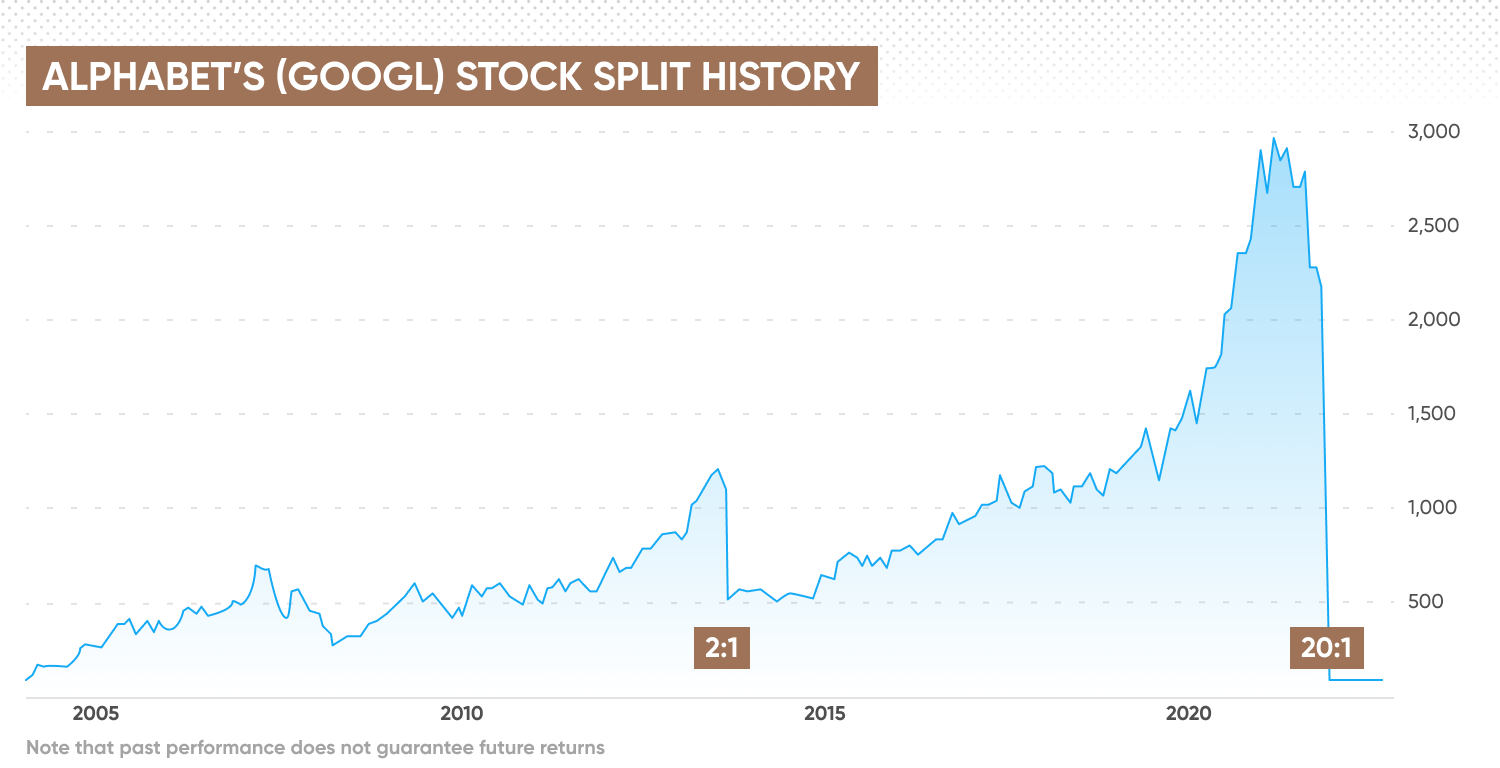

As of October 2023, Alphabet’s share price has shown significant volatility influenced by various global economic factors and internal company developments. Following a steady rise earlier in the year, the stock experienced a downturn in August due to an overall decline in tech shares amid rising interest rates. As of the latest reporting, Alphabet’s share price is trading at approximately £2,500 per share.

Key Influences on Share Price

Several factors have affected Alphabet’s stock performance. Firstly, regulatory challenges in the EU and US regarding antitrust issues have raised concerns among investors. Additionally, changes in digital advertising revenue, which constitutes a substantial portion of Alphabet’s income, have caused fluctuations in share price as advertisers recalibrate their budgets amidst economic uncertainty.

The company’s advancements in artificial intelligence and cloud computing solutions are also significant. Recent announcements regarding their substantial investments in AI technology have led to positive market speculation. Analysts note that potential breakthroughs in these areas could bolster Alphabet’s profitability in the long term.

Outlook and Predictions

Despite current market fluctuations, analysts maintain a generally positive outlook on Alphabet’s long-term prospects. Many experts suggest that the stock remains undervalued relative to its growth potential, especially as demand for digital services continues to rise. Future earnings reports will be critical in shaping investor sentiment moving forward.

Market analysts project that Alphabet’s share price could reach new highs if the company continues to innovate and navigate regulatory challenges effectively. Investors are advised to stay informed about upcoming earnings reports and industry developments that could impact the overall tech market.

Conclusion

The share price of Alphabet Inc. continues to be a focal point for investors, reflecting broader economic trends while also being influenced by specific company developments. As we approach the end of 2023, maintaining awareness of these factors will be beneficial for those looking to invest in or track Alphabet’s financial journey. Overall, the outlook remains cautiously optimistic, contingent on Alphabet’s ability to adapt and lead in an evolving technological landscape.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial