Introduction

The share price of BT Group plc (BT), one of the largest telecommunications companies in the UK, is a crucial indicator of its market performance and overall business health. With the ever-evolving landscape of the telecom industry and the growing demand for digital services, investors closely monitor BT’s share price movements. Recently, fluctuations in the market due to economic uncertainties and competitive pressures have sparked interest in BT’s stock performance.

Current Market Performance

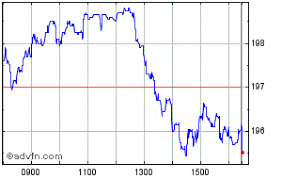

As of October 2023, BT’s share price has experienced significant shifts, reflecting broader market trends and company-specific developments. The stock has seen a slight increase of approximately 2.5% over the last month, currently trading around £1.80 per share. This uptick comes after a period of volatility attributed to regulatory changes and ongoing competition from other major telecom operators such as Vodafone and Sky.

Investors have noted improvements in BT’s performance, driven by cost-cutting measures and a strategic focus on expanding their broadband network. Analysts are optimistic about the company’s growth potential, especially as demand for fibre-optic broadband continues to rise across the UK.

Key Factors Influencing BT’s Share Price

Several factors impact BT’s share price, including:

- Regulatory Environment: Recent regulation adjustments asked BT to enhance infrastructure obligations which, while costly in the short term, are expected to foster long-term growth.

- Market Competition: The competitive landscape remains fierce with rivals aggressively marketing their services. BT’s ability to adapt and innovate will be essential for maintaining its market position.

- Economic Conditions: Broader economic conditions, including inflation rates and consumer spending power, can significantly impact the telecom sector.

- Diversification Initiatives: BT’s expansion into new technology sectors, such as smart homes and cybersecurity, may influence future share price stability and potential growth.

Conclusion

In conclusion, BT’s current share price reflects a complex interplay of industry challenges and opportunities. Investors should continue to monitor BT’s strategic initiatives, alongside the regulatory landscape and market competition, as these factors will be critical in determining the future direction of its stock. The current share price, while slightly increased, suggests that the market is cautiously optimistic about BT’s ability to navigate through challenges and capitalise on growth opportunities in the evolving telecom landscape.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial