Introduction

The Lloyds share price has become a focal point for investors as it reflects the health of the UK banking sector amidst economic fluctuations.

Current Market Overview

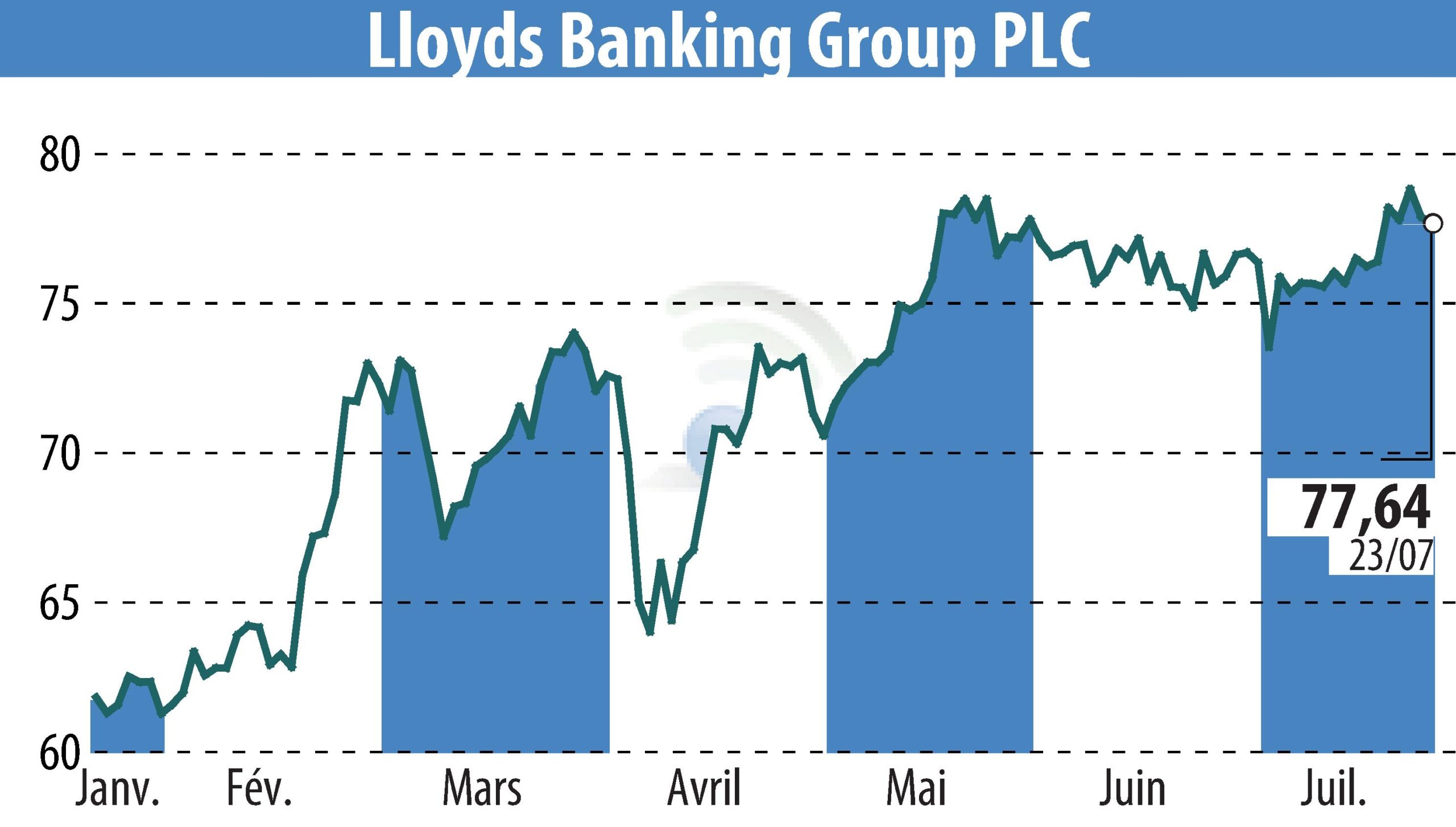

As of October 2023, Lloyds Banking Group’s share price has seen notable movements, recently hovering around £0.50 per share, which signals both investor sentiment and broader economic indicators. The bank has faced challenges including rising interest rates and market volatility, which have influenced trading patterns.

Factors Impacting Lloyds Share Price

Several key factors have been influencing the Lloyds share price in recent months:

- Interest Rates: The Bank of England’s monetary policy, particularly the decision to increase interest rates, has a direct impact on Lloyds’ profit margins and lending practices.

- Inflation Rates: Stubbornly high inflation is squeezing consumers and businesses alike, which results in increased defaults and potential impacts on Lloyds’ loan portfolios.

- Market Sentiment: Investor confidence, bolstered by Lloyds’ recent quarterly earnings reports, showed resilience despite economic headwinds; however, fluctuating market conditions can rapidly change perceptions.

- Regulatory Changes: Ongoing changes in banking regulations and potential reforms introduced in Parliament could also influence future valuations.

Recent Developments

Recent announcements from the bank regarding its strategic priorities, focusing on digitalisation and expanding customer-centric services, are designed to bolster its position in the competitive banking market. Analysts predict that these shifts could positively influence Lloyds’ long-term share price trajectory.

Conclusion

The outlook for the Lloyds share price remains cautiously optimistic as the bank navigates a complex economic landscape. Investors are advised to keep a close watch on macroeconomic factors, regulatory changes, and corporate strategies that could further influence share price movements in the coming months. The steadfast nature of Lloyds’ customer engagements combined with strategic initiatives may pave the way for recovery and growth in the share price, making it a subject of keen interest for both seasoned and new investors.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial