Introduction

The stock market is a reflection of the larger economic environment, and companies like Netflix are often at the forefront of investor attention. As one of the leading streaming platforms globally, the Netflix share price serves as an indicator not only of the company’s performance but also of trends in consumer behaviour and entertainment consumption. Recent fluctuations in Netflix’s share price have spurred investor interest, making it crucial to examine the factors influencing these changes.

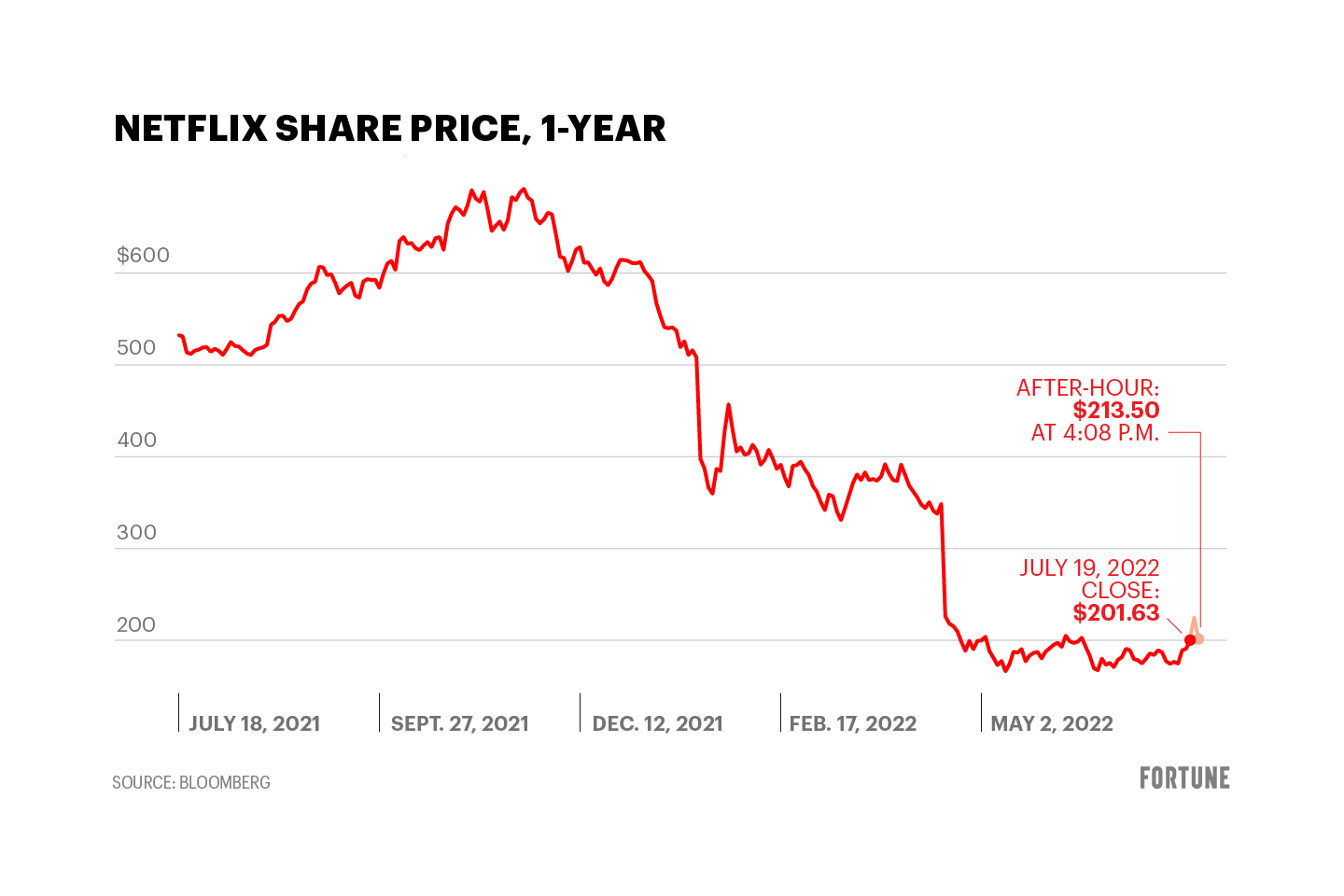

Recent Performance

As of October 2023, Netflix’s share price has seen a significant rise, trading around £485, up from about £400 at the beginning of the month. This surge can be attributed to several key factors, including the release of major blockbuster films and series that have captivated audiences worldwide as well as expansion into gaming services. Netflix reported a solid increase in subscriber numbers in its latest earnings report, indicating that its content strategy is proving effective.

Factors Influencing Share Price

A few critical elements contributing to the recent increase in share price include:

- Content Quality: The recent debut of high-quality original content has driven viewership, leading to a higher retention rate of existing subscribers and attracting new ones.

- Business Strategy: Netflix’s continuous effort to diversify its offerings, including an aggressive foray into gaming, has played a crucial role in enhancing its appeal beyond traditional streaming.

- Market Trends: Broader market conditions, including a recent rebound in tech stocks, have also positively impacted Netflix’s valuation, as investors show renewed confidence in tech-driven companies.

Future Outlook

Looking ahead, analysts suggest that Netflix’s share price could face volatility attributed to stiff competition from other streaming services and fluctuating consumer spending. However, if the company continues to innovate and deliver high-quality content, it may sustain its upward trajectory. Analysts predict that Netflix may hit £500 per share by the end of the year if current trends persist.

Conclusion

The Netflix share price remains a focal point for investors seeking insight into the company’s future performance and the streaming industry’s health. As Netflix adapts to changing market dynamics and continues to deliver compelling content, it will be interesting to observe how these trends evolve, and whether its share price can sustain growth in a competitive landscape. By staying informed on Netflix’s operations and market influences, investors will be better positioned to navigate potential fluctuations in its share price.

You may also like

Current Top Movies on Netflix You Should Watch

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial