Introduction

The share price of Shell, one of the world’s largest oil and gas companies, holds significant importance for investors and the energy market alike. Understanding the fluctuations in Shell’s stock price can provide valuable insights into industry trends and help gauge the company’s financial health. In recent months, Shell’s share price has been influenced by various factors, including global economic conditions, changes in oil prices, and the energy transition towards more sustainable sources.

Recent Developments

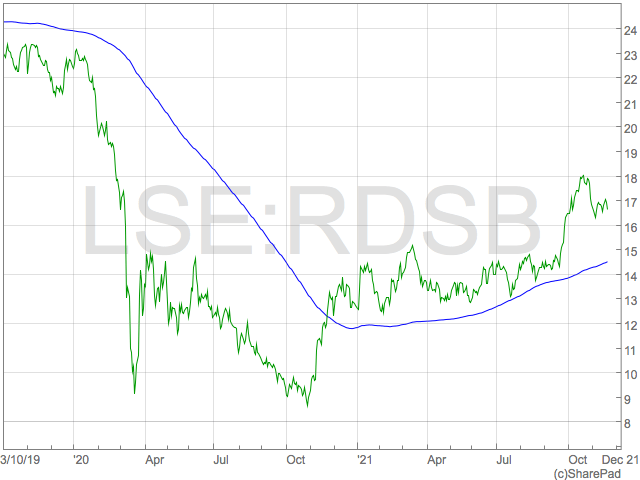

As of October 2023, Shell’s share price has exhibited a degree of volatility, reflecting broader market trends in energy stocks. According to financial data from market analysts, Shell’s shares reached a peak of £25.75 in September before experiencing a downturn in October, currently hovering around £24.40. Analysts attribute this decline to several key factors, including fluctuating crude oil prices, which saw a decline from recent highs amid increasing concerns over a potential global recession.

Additionally, Shell’s commitment to transitioning to renewable energy has sparked discussions among investors. The company has set ambitious targets to reduce its carbon footprint and increase investments in renewable energy sources. While these initiatives are positively regarded in the long term, the immediate impact on profitability and share price remains a topic of debate. The market’s response to Shell’s quarterly earnings report in November will be critical in shaping investor sentiment moving forward.

Market Implications

The stock market’s reaction to Shell’s fluctuations is also influenced by geopolitical dynamics, particularly those involving major oil-producing nations. OPEC’s decisions regarding oil production cuts or increases can impact crude oil prices, which directly affects companies like Shell. Furthermore, macroeconomic factors such as inflation rates and interest rates are weighing heavily on energy stocks overall.

Investors should note that, despite the current challenges, many analysts maintain a positive outlook on Shell’s long-term prospects, citing its strong fundamentals, robust cash flow, and strategic focus on sustainable energy development. Market analysts have issued mixed ratings, with several recommending a ‘buy’ position for investors optimistic about the future of energy stocks.

Conclusion

In conclusion, while the fluctuations in Shell’s share price reflect various external and internal pressures, the company’s strategic pivot towards renewable energy and its resilient business model may provide a buffer against ongoing market volatility. As the global economy navigates uncertainties and the energy sector undergoes transformative changes, investors must stay informed about developments related to Shell’s share price and broader market trends. With upcoming earnings reports and potential oil price developments, the next few months will be pivotal for those invested in Shell and the energy market.

You may also like

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial