Introduction

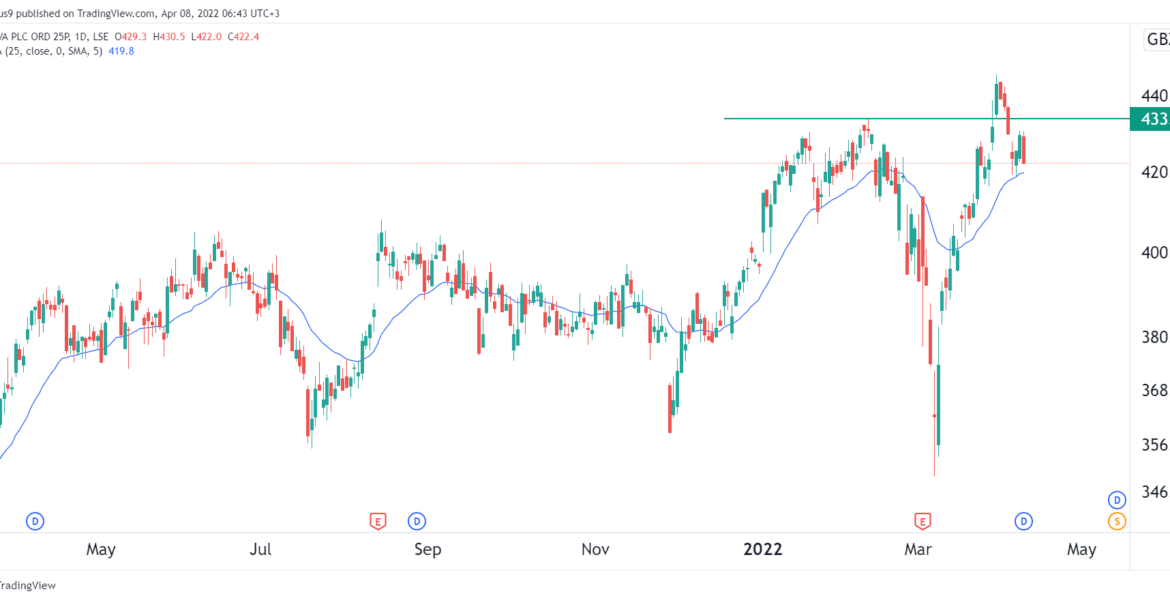

The Aviva share price is a crucial indicator for investors looking to gauge the performance of one of the UK’s leading insurance and financial services companies. Recently, this price has drawn attention due to a combination of market trends, company performance, and broader economic factors, making it an essential topic for both current and prospective shareholders.

Recent Developments

As of October 2023, Aviva has seen fluctuations in its share price, largely influenced by the UK’s economic environment, interest rate adjustments, and company-specific developments. The company’s latest financial report revealed a robust performance in premium growth, attributing this to increased consumer demand for insurance products amid a rising inflation scenario. Following the report, Aviva’s shares saw a modest rise, reflecting investor confidence.

Market Factors Influencing Prices

Several external factors have impacted the Aviva share price this year. The Bank of England’s monetary policies, particularly concerning interest rates, play a significant role in shaping investor behaviour. For instance, amidst rising interest rates aimed at curbing inflation, insurance companies like Aviva may benefit from higher returns on investments, consequently boosting shareholder value.

Furthermore, market sentiment surrounding the insurance sector, linked to regulatory changes and environmental considerations, continues to be prominent. For instance, Aviva has been proactive in aligning its investment portfolio with sustainable practices, which is positively viewed by investors seeking ESG-compliant options.

Conclusion

In conclusion, the Aviva share price remains a focal point for understanding the company’s market position and potential growth. Investors should closely monitor relevant economic indicators and company announcements to make informed decisions. With Aviva’s strategic responses to current market challenges, including a clear focus on digital transformation and customer-centric solutions, the outlook for its share price seems cautiously optimistic in the latter part of 2023 and beyond. By staying informed, shareholders can better navigate the complexities of the market and position themselves for potential growth.

You may also like

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football