Introduction to the FTSE

The Financial Times Stock Exchange (FTSE) index is a crucial indicator of the performance of the UK stock market, tracking the performance of the 100 largest companies listed on the London Stock Exchange. As an important benchmark, it is closely followed by investors, analysts, and economists alike. Recent fluctuations in the FTSE have implications for investor sentiment and economic forecasts, making it a topic of significant relevance.

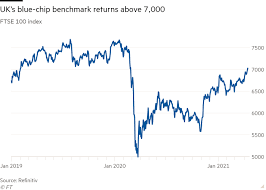

Recent Performance of the FTSE

As of mid-October 2023, the FTSE 100 index has exhibited notable resilience amid global market uncertainties. The index closed at approximately 7,200 points, reflecting a mild increase of about 3% over the past month. This uptick has been largely attributed to strong performances in the energy and financial sectors, alongside a recovery in consumer confidence.

Sector-wise, oil and gas companies have been buoyed by rising crude prices, while banking institutions have benefited from higher interest rates. Reports indicate that companies such as BP and HSBC have posted encouraging quarterly earnings, contributing to the overall positive momentum of the FTSE.

Economic Context

The performance of the FTSE is closely tied to broader economic indicators. The UK’s inflation rate has shown signs of stabilising, currently sitting around 4.5%, which has eased fears of aggressive rate hikes from the Bank of England. This stability is viewed favourably by investors as it allows for more predictable corporate earnings, thus supporting stock valuations.

Investor Sentiment and Future Outlook

Market analysts predict that the FTSE will remain influenced by geopolitical concerns, including ongoing tensions regarding trade and the conflict in Ukraine. However, positive domestic economic indicators such as rising employment rates and consumer spending could bolster the index in the coming months. Some experts suggest that the FTSE could reach 7,500 points by the year’s end if the current momentum persists.

Conclusion

In summary, the FTSE remains a focal point for understanding the health of the UK economy and market sentiment. While challenges remain, the recent positive trends indicate a potential upturn for investors. Keeping a close watch on economic indicators and geopolitical developments will be essential for those looking to navigate this dynamic market effectively.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial