Understanding the Importance of the UK Inflation Rate

The inflation rate is a critical economic indicator that reflects the changes in prices of goods and services over time. It impacts consumer purchasing power and influences monetary policy decisions by the Bank of England. Monitoring the UK inflation rate is essential for households, businesses, and policymakers as it provides insights into overall economic health and living costs.

Current Inflation Trends in the UK

As of September 2023, the UK inflation rate stands at 6.7%, a decrease from previous months, reflecting the government’s efforts to manage economic pressures post-COVID-19 and amid global supply chain disruptions. This decline is largely attributed to easing energy prices and a reduction in food inflation. However, core inflation, which excludes volatile items like food and energy, remains stubbornly high at around 5.9%.

Implications for Consumers and Businesses

The current inflation rate has far-reaching implications for UK consumers and businesses. While the slight decrease in the inflation rate can be seen as positive news for households, many are still feeling the pinch as wages in real terms remain stagnant. The rising cost of living continues to strain household budgets. For businesses, especially small and medium enterprises (SMEs), the inflation rate affects operational costs, impacting profitability and consumer demand.

Government and Bank of England Responses

In response to inflationary pressures, the Bank of England has been cautious in its monetary policy, indicating potential interest rate adjustments to manage economic stability. Recent forecasts suggest that inflation may stabilize around 4% by mid-2024, contingent upon external economic factors and domestic policy measures. The government is actively working to mitigate inflationary pressures through strategic investments and fiscal policies aimed at stimulating growth.

Conclusion: The Road Ahead

As we move towards the end of 2023, monitoring the UK inflation rate remains paramount for predicting economic trends. While the current decrease in inflation provides some relief, ongoing global uncertainties pose challenges ahead. Households and businesses alike must remain vigilant and adapt to the evolving economic landscape. Understanding these dynamics will be crucial for making informed financial decisions in the near future.

You may also like

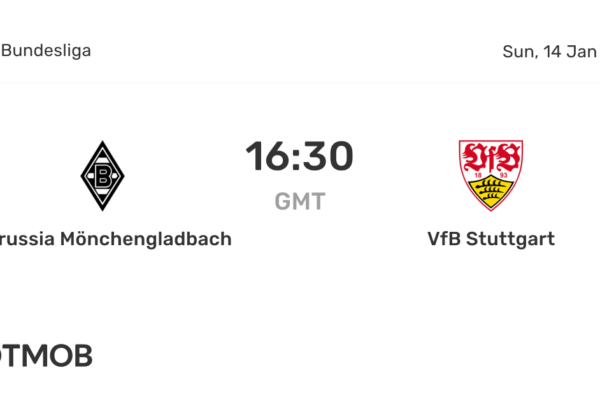

Mönchengladbach vs VfB Stuttgart: A Match to Remember

James Bree: The Promising Journey of a Young Football Star