Introduction

Inflation has been a key topic of discussion in the United States as it profoundly impacts economic stability, purchasing power, and consumer behaviour. As of late 2023, the inflation rate is a critical point of focus for policymakers and citizens alike, shaping decisions from interest rates to consumer spending.

The Current State of US Inflation

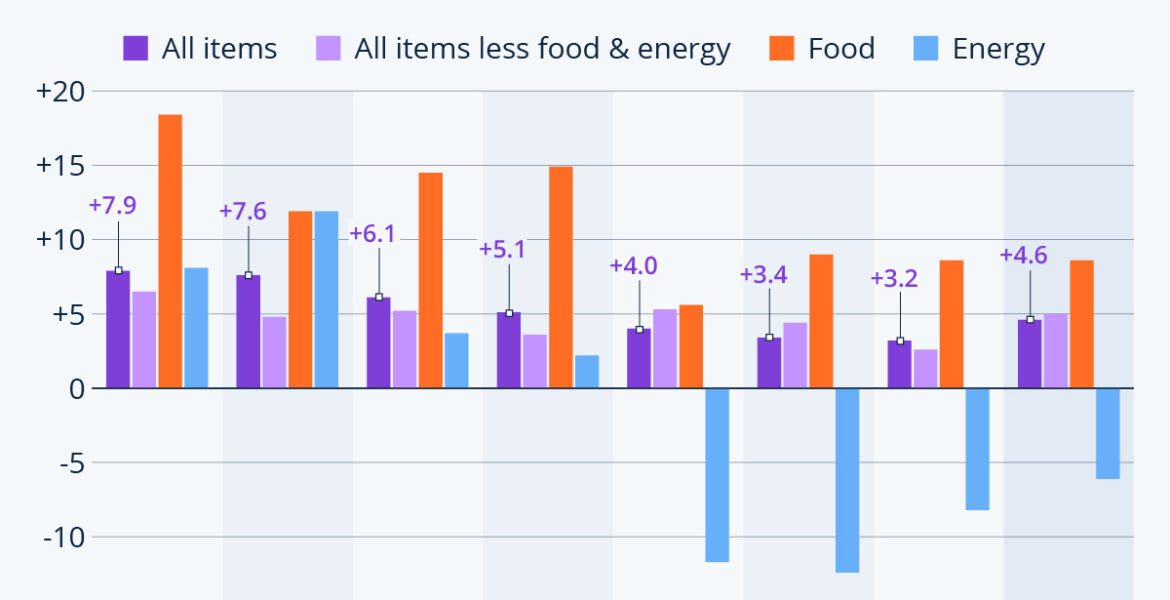

According to the Bureau of Labor Statistics (BLS), the annual inflation rate in the United States was around 3.7% as of September 2023, slightly lower than earlier in the year. This marks a significant decrease from the peak inflation rate of over 9% in mid-2022. The drop is attributed to various factors including easing supply chain issues, decreasing energy prices, and the Federal Reserve’s aggressive interest rate hikes aimed at curbing inflation.

Causes of Inflation

The primary drivers of inflation currently include:

- Supply Chain Disruptions: While improving, these disruptions from the COVID-19 pandemic still affect product availability and pricing.

- Energy Prices: Following a surge in oil prices due to geopolitical tensions, prices have begun to stabilise, contributing to easing inflation rates.

- Wage Increases: As businesses struggle to hire workers, wages have risen, which can contribute to higher prices as businesses pass on costs to consumers.

Impact on Consumers and Businesses

As inflation stabilises, consumers are beginning to feel the pressure ease on their wallets, but challenges remain. Essential goods and services, particularly food and housing, continue to experience price surges. Businesses are also adjusting to the changing landscape, with many implementing cost-saving measures or price adjustments to maintain margins. The Federal Reserve’s rate hikes have led to increased borrowing costs, impacting mortgages and loans, which could slow down the housing market.

Conclusion

As we move forward, the outlook for US inflation remains cautiously optimistic. Analysts suggest that, barring any new shocks to the global economy, inflation may continue to decline towards more stable levels. However, the Federal Reserve faces the delicate balancing act of managing inflation without stifling economic growth. For consumers and businesses alike, understanding these trends will be crucial in making informed financial decisions in the near future.

You may also like

The Journey of Reuniting with Long Lost Family