Introduction

The price of Ethereum (ETH), the second-largest cryptocurrency by market capitalisation, plays a significant role in the digital asset space. As the world continues to embrace blockchain technology and decentralised finance (DeFi), understanding Ethereum’s price movements is essential for investors, traders, and enthusiasts alike. Its volatility can present both opportunities and risks, making it a focal point for analysis.

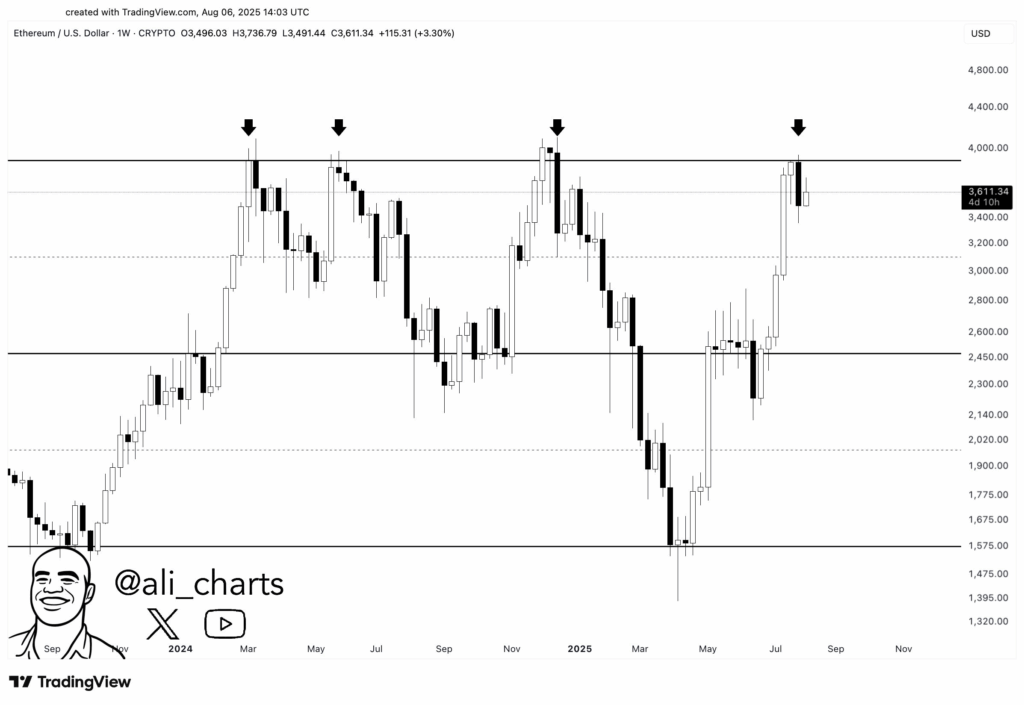

Current State of Ethereum Price

As of October 2023, Ethereum’s price stands at approximately £1,650, having seen significant fluctuations throughout the year. After reaching an all-time high of £3,600 in November 2021, Ethereum experienced a downturn, largely influenced by global economic factors, changing market sentiment, and regulatory scrutiny of cryptocurrencies. Unlike Bitcoin, which is often treated as a digital gold, Ethereum’s value is also driven by the smart contracts and decentralised applications built on its platform.

Factors Influencing Ethereum Price

Several key factors influence Ethereum’s price, including:

- Market Sentiment: Social media trends and investor enthusiasm can lead to price spikes or drops as seen in various market cycles.

- Technological Developments: Advances and upgrades to the Ethereum network, such as the transition to Ethereum 2.0, which aims to enhance scalability and reduce energy consumption, can impact price positively.

- Regulatory News: Announcements from government bodies regarding cryptocurrency regulations can sway investor confidence, leading to price volatility.

- Global Economics: Broader economic trends, including inflation rates, interest rates, and financial crises can influence investor behaviour towards risk assets, including cryptocurrencies.

Market Predictions

Analysts and experts provide varying outlooks for Ethereum’s future price. Some predict a recovery and gradual increase, targeting prices ranging between £2,000 to £2,500 by early 2024, driven by increased institutional adoption and ongoing development within the DeFi ecosystem. Conversely, bearish forecasts suggest that market corrections may lead to further declines, depending on macroeconomic conditions and sentiment shifts within the crypto markets.

Conclusion

Ethereum’s price remains a crucial topic for investors and market participants. As developments continue within the ecosystem, staying informed about factors influencing its price can provide important insights for strategic investment decisions. While the future of Ethereum looks promising due to technological advancements and growing adoption, potential risks should not be underestimated. As the digital asset landscape evolves, so too will the factors affecting Ethereum’s valuation, making it paramount to remain vigilant in this dynamic market.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial