Importance of the Tax Filing Deadline

The tax filing deadline is a critical date for taxpayers in the UK, as it marks the final opportunity for individuals and businesses to submit their tax returns and ensure compliance with HM Revenue and Customs (HMRC) regulations. Missing this deadline can lead to significant financial penalties and interest on owed taxes, making awareness and preparation essential for anyone with tax obligations.

Key Dates and Requirements

The deadline for filing your Self Assessment tax return for the 2022/23 tax year is 31 January 2024, for those filing online. This date is also the deadline for making any payments due for this tax year. For taxpayers who prefer to file via paper forms, the deadline is earlier, on 31 October 2023. If you miss these deadlines, HMRC may impose an automatic penalty of £100, regardless of whether tax is owed.

Current Trends and Insights

As the deadline approaches, HMRC has noted an increase in inquiries from individuals and businesses seeking assistance with the filing process. This has led to a rise in the use of digital accounting tools and tax preparation services. Many taxpayers are leveraging online platforms that offer user-friendly interfaces and guides to streamline the filing process. According to recent reports, over 4.5 million tax returns were filed in January 2023 alone, showcasing the significant volume of submissions during peak periods.

Preparing for the Deadline

Taxpayers are encouraged to gather necessary documentation early, including P60s, P45s, and records of self-employed income. Additionally, ensuring that all relevant expenses and allowances are accounted for can help reduce taxable income. Experts recommend consulting with a tax professional, especially for those with complex financial situations or uncertainties regarding new tax laws.

Conclusion: Significance for Taxpayers

Understanding the implications of the tax filing deadline is imperative for all taxpayers in the UK. With the potential for penalties and interest charges, timely filing is crucial not just for compliance but also for avoiding unnecessary financial strain. As this deadline approaches, taking proactive steps can ease the process, ensuring taxpayers meet obligations confidently and accurately. Looking forward, HMRC is expected to enhance its digital services to better support individuals and businesses navigating their tax responsibilities.

You may also like

Current Top Movies on Netflix You Should Watch

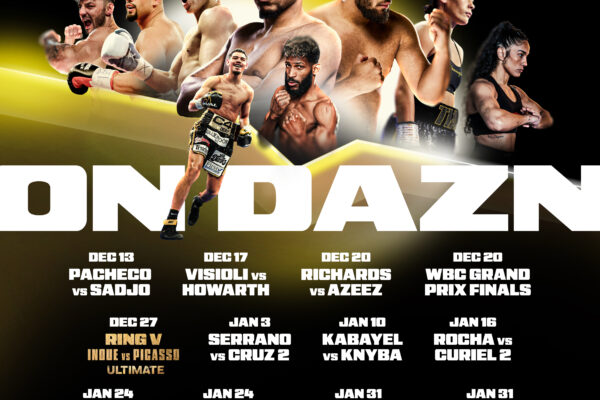

DAZN’s Comprehensive Coverage of the Super Bowl