Introduction to the FOMC

The Federal Open Market Committee (FOMC) plays a critical role in shaping US monetary policy and influencing the global economy. Comprised of members from the Federal Reserve, the FOMC meets regularly to assess economic conditions and make decisions regarding interest rates and economic measures. These decisions hold significant weight, affecting inflation rates, employment levels, and, ultimately, the financial well-being of citizens. With the ongoing economic recovery following past recessions, understanding the FOMC’s recent actions is more relevant than ever.

Recent Actions and Meetings

In its latest meeting on September 20, 2023, the FOMC decided to keep interest rates unchanged at 5.25% to 5.50%. This marks a continued pause in rate hikes after a sequence of increases aimed at combating inflation, which has shown signs of moderating recently. According to the US Bureau of Labor Statistics, inflation stood at 3.7% in August, down from a year earlier. The Fed’s cautious approach reflects its commitment to stabilising prices while avoiding a downturn in economic growth.

Jerome Powell, the chair of the FOMC, emphasised that while inflation is declining, it remains a priority for the committee to ensure it converges back to the target rate of 2%. The FOMC’s statements indicate that future decisions will depend heavily on evolving economic data, particularly regarding labour market trends and consumer spending.

Impact on Financial Markets

The FOMC’s decisions have immediate consequences for financial markets. After the recent announcement, equity markets experienced volatility, with investors reacting to the Fed’s indication of potential interest rate changes in 2024. Bonds and equities are closely monitored for signals of monetary policy adjustments, and analysts posit that rates might be lowered if inflation continues to ease. Currency fluctuations also reflect the market’s sentiment regarding the Fed’s future actions.

Conclusion: The FOMC’s Significance

The FOMC’s role in shaping monetary policy is paramount, especially as the economy navigates the complexities of post-pandemic recovery. Their decisions do not only affect US economic conditions but also have ripple effects across the globe, influencing international markets. As economic challenges such as inflation persist, the path forward will require careful consideration and transparency to maintain market confidence. Investors and citizens alike need to keep an eye on FOMC announcements, as their implications are far-reaching and can affect financial stability and economic prosperity for years to come.

You may also like

The Dynamics of Price in the Modern Economy

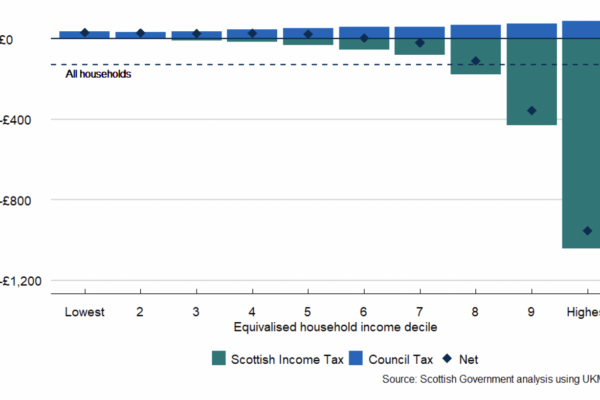

Overview of Scottish Budget Income Tax Changes in 2023

Current Status of the Bank of England Base Rate

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial