Introduction

The banking sector stands at a pivotal juncture as it navigates the rapid evolution of technology and consumer expectations. With a growing emphasis on digital banking solutions, understanding the future of banks is essential for both consumers and financial institutions alike. As digitalisation transforms how consumers interact with their finances, banks must adapt or risk obsolescence.

Current Events in Banking

Recent reports indicate that a surge in online banking usage has prompted traditional banks to enhance their digital offerings significantly. According to a study by the British Bankers’ Association, around 90% of transactions in the UK are now conducted through online or mobile platforms. In response to this trend, several banks are investing heavily in cybersecurity measures, user interface upgrades, and artificial intelligence to improve customer service.

Moreover, the rise of fintech companies poses both challenges and opportunities for traditional banks. Neobanks, which operate solely online without physical branches, are attracting younger customers with their streamlined services and lower fees. This shift has prompted established banks to launch their own digital-only services to stay competitive.

Data and Insights

According to Statista, the online banking market in the UK is expected to reach a value of approximately £175 billion by 2026. Furthermore, consumer preference for mobile banking has led banks to innovate their applications to offer features such as personalised financial advice, budgeting tools, and instant loan approvals. In the current landscape, banks that embrace technological advancements and prioritise user experience will likely thrive.

Future Outlook

Experts predict that the future of banking will be defined by further integration of technology. With the advent of cryptocurrencies and blockchain technology, banks may also need to rethink their approach to currency and payments. Regulatory bodies are anticipated to adapt to these innovations by establishing frameworks that protect consumers while fostering innovation.

Conclusion

The banking sector is undoubtedly in a state of transformation. As digitalisation continues to reshape consumer behaviours, financial institutions must focus on adaptability and innovation. For consumers, staying informed about these changes is vital, as they will significantly impact how they manage their finances and engage with banking services in the coming years. Understanding the evolving dynamics in banking could lead to more informed choices and enhanced financial literacy.

You may also like

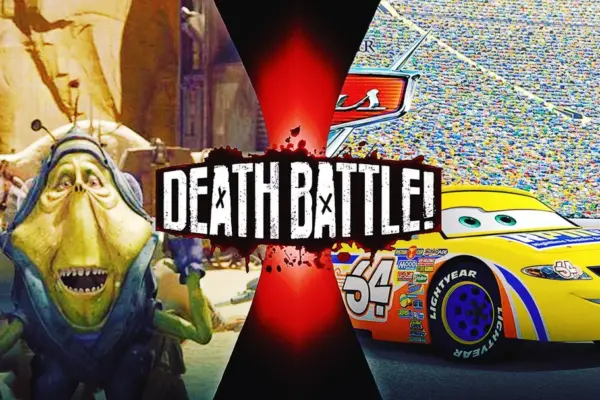

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football