Introduction

Fintech innovation has become a pivotal aspect of the financial services landscape in recent years. As technology evolves, so does the way consumers interact with financial products and services. The relevance of fintech innovation is underscored by its ability to improve accessibility, efficiency, and transparency within the sector, making it a topic of utmost importance for businesses and consumers alike.

The Rise of Fintech Innovation

The term ‘fintech’ combines ‘financial’ and ‘technology’, representing any technological innovation in the management of money. This sector has witnessed exponential growth, propelled by the increasing demand for digital solutions. In 2023, global investment in fintech exceeded $100 billion, reflecting a significant shift towards digitisation in banking, investing, insurance, and payment systems.

Key players in fintech include payment processors like PayPal and Stripe, lending platforms such as LendingClub, and investment apps like Robinhood. These innovators have disrupted traditional business models and provided consumers with alternative options, leading to more competitive pricing and enhanced user experiences.

Recent Developments and Innovations

Recent innovations in the fintech space include the rise of blockchain technology and cryptocurrencies, which have altered the traditional notions of currency and value transfer. Central Bank Digital Currencies (CBDCs) are also gaining traction, with several countries, including China and the UK, exploring their potential benefits.

Additionally, artificial intelligence (AI) and machine learning (ML) are being increasingly integrated into financial services, enabling better risk management, fraud detection, and personalized customer experience. Companies utilizing these technologies can analyse vast amounts of data to offer tailored solutions, thereby improving customer satisfaction and loyalty.

The Challenges Ahead

Despite the promise of fintech innovation, challenges remain. Regulatory frameworks across different nations struggle to keep pace with rapid technological advancements, raising concerns regarding consumer protection and data privacy. The fintech industry must work closely with regulators to develop guidelines that safeguard consumers while fostering innovation.

Conclusion

Fintech innovation continues to redefine financial services, benefiting both consumers and businesses through enhanced services and greater efficiency. As the sector evolves, it is essential for stakeholders to address regulatory challenges while embracing technological advancements. The future of financial services is undoubtedly intertwined with fintech innovation, shaping a more inclusive and efficient financial landscape for all.

You may also like

Current Top Movies on Netflix You Should Watch

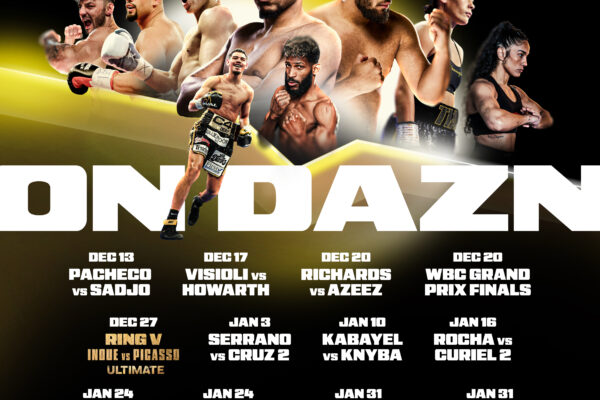

DAZN’s Comprehensive Coverage of the Super Bowl