The Importance of the S&P 500 in Today’s Financial Landscape

Introduction

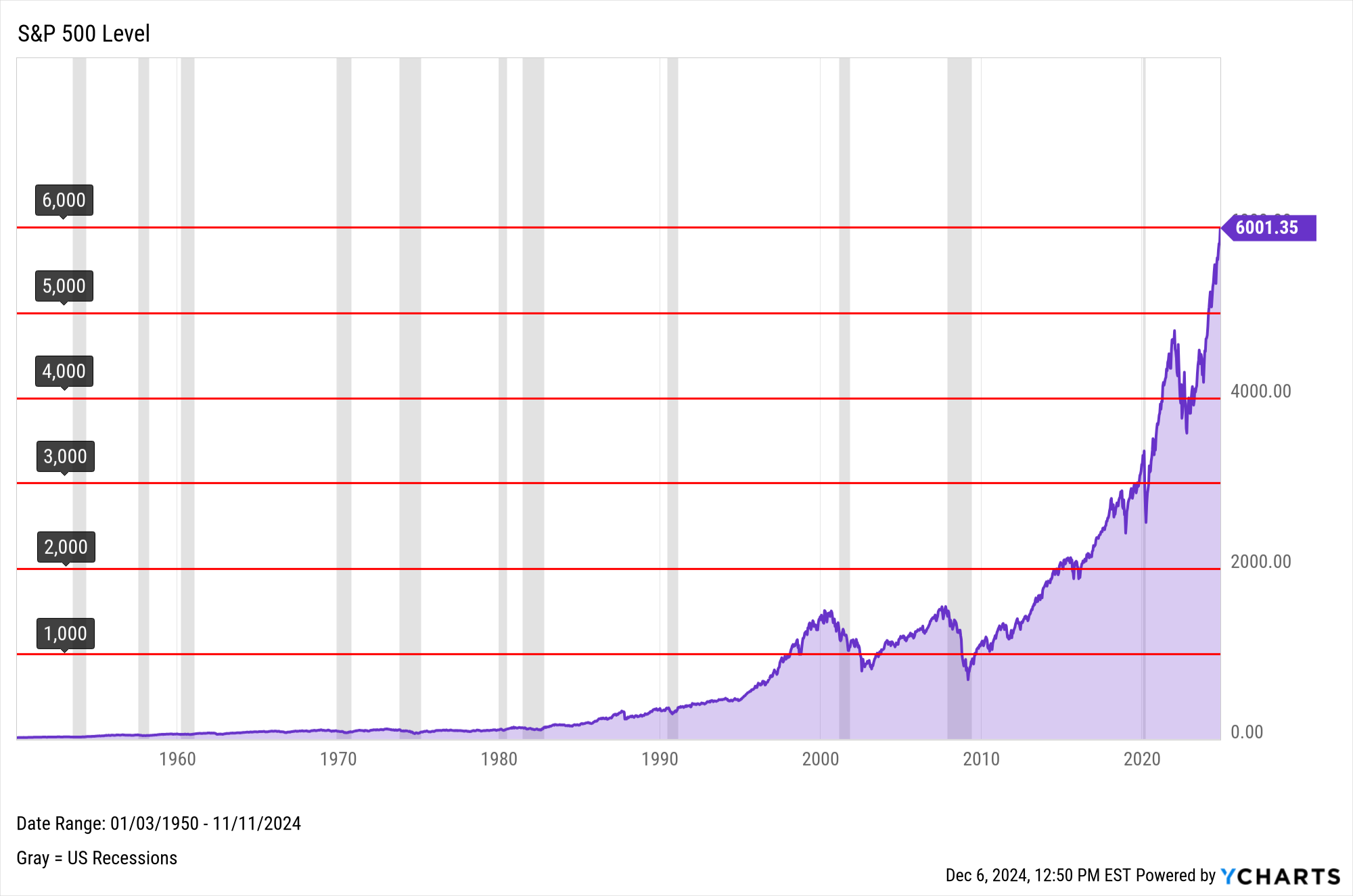

The S&P 500 Index is a crucial benchmark in the world of finance, representing the performance of 500 of the largest publicly traded companies in the United States. It is widely regarded as a barometer for the overall health of the U.S. stock market and the economy. As investors keep a close eye on market trends, understanding the S&P 500’s movements becomes increasingly relevant in navigating today’s volatile economic landscape.

Recent Performance and Key Developments

As of October 2023, the S&P 500 has demonstrated notable resilience amid shifting economic conditions. Following a downturn earlier in the year, the index has rebounded strongly, witnessing a growth of approximately 15% since its low in March. This recovery has been propelled by positive earnings reports from key sectors such as technology and healthcare, signaling investor confidence in corporate profitability.

Recent data from S&P Dow Jones Indices indicates that nearly 80% of the companies within the index have reported earnings that exceeded analyst expectations, further solidifying the index’s upward trajectory. However, concerns over inflation and interest rate hikes continue to linger, impacting investor sentiment. The Federal Reserve’s recent decision to maintain interest rates has helped stabilize the market, with many analysts predicting a cautious but steady growth moving forward.

Importance for Investors

For individual and institutional investors alike, the S&P 500 serves as a critical tool for assessing market performance and making informed investment decisions. Its diversity across sectors, including technology, healthcare, finance, and consumer goods, offers investors a balanced exposure to various economic conditions. Furthermore, the index serves as a standard benchmark against which the performance of mutual funds and ETFs can be measured, guiding investment strategies.

Conclusion

In conclusion, the S&P 500 remains a vital indicator of economic health in the United States, reflecting the underlying performance of some of the country’s most significant companies. As inflationary pressures and economic uncertainties ebb and flow, investors must stay informed about the movements of this key index. With ongoing developments in the financial landscape, forecasts for the S&P 500 indicate a potential for continued growth, making it an essential element for anyone keen to navigate investments in the current market environment.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Current Trends in Unilever Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial