Introduction

The Bank of England’s interest rate decisions are crucial for the UK economy, influencing everything from mortgage rates to inflation. As the nation navigates post-pandemic recovery and grapples with rising inflation, understanding the Bank’s monetary policy and interest rate changes has never been more vital for consumers and businesses alike.

Recent Developments

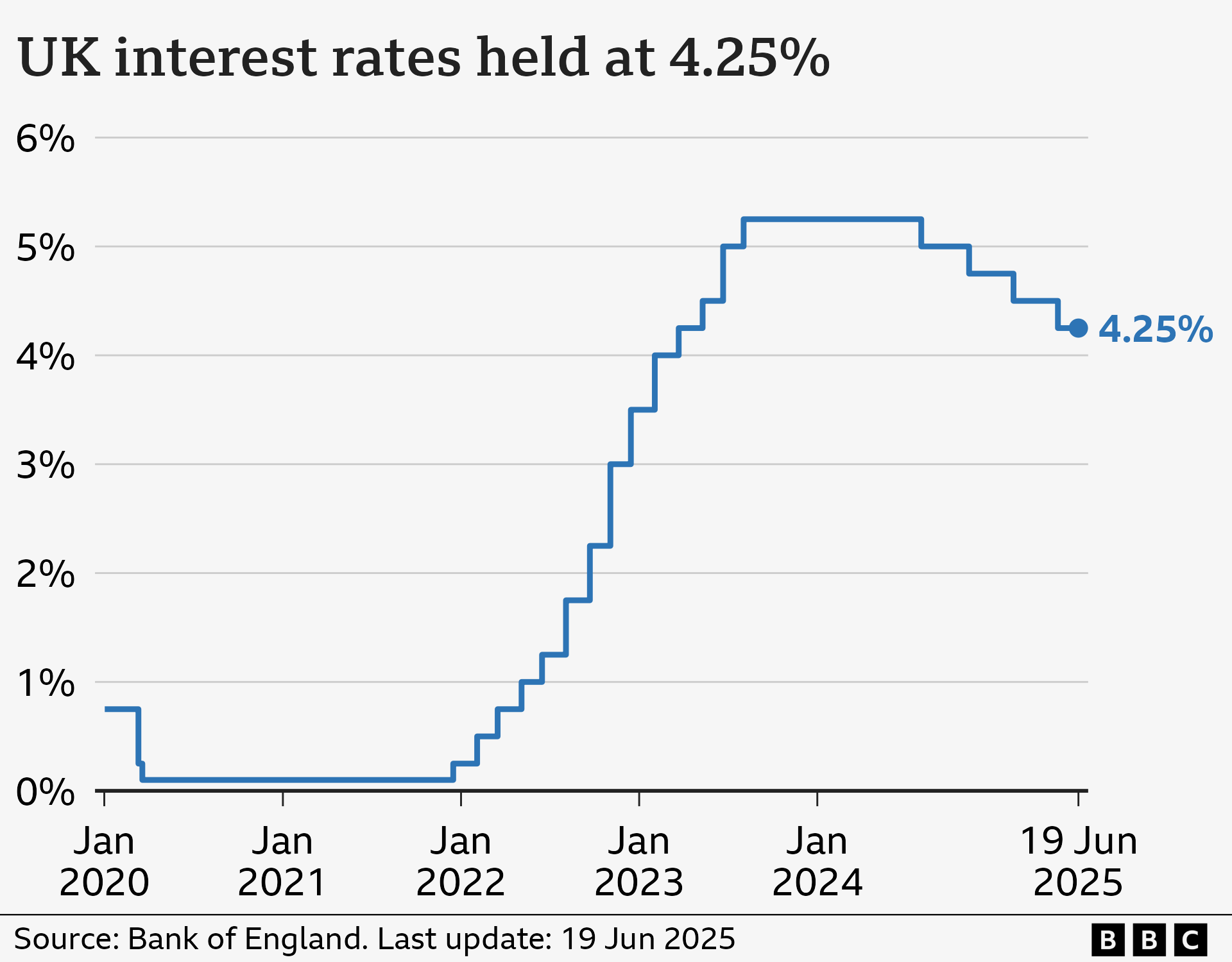

On 5 October 2023, the Bank of England announced a decision to maintain the interest rate at 5.25%, following a series of hikes that began in late 2021. The decision to hold rates steady comes as inflation has shown signs of easing, with the Consumer Prices Index (CPI) falling from its summer peak of 11.1% to 5.2% in September 2023. This adjustment reflects the Bank’s commitment to balancing growth with its inflation target, aiming to keep inflation around the 2% mark.

The Monetary Policy Committee (MPC) noted that while inflation pressures are reducing, the labour market remains robust. Unemployment rates have declined, with job vacancies still high, indicating strong consumer demand. However, the potential threat of a resurgence in inflation due to high wages and energy prices continues to loom, which may influence future interest rate decisions.

Economic Implications

The ramifications of the Bank of England’s interest rate decisions extend beyond just saving and borrowing; they affect businesses, investments, and economic growth. Maintaining interest rates at 5.25% may encourage spending and investment, allowing for a smoother recovery post-COVID. However, the Bank warned that rates may need to rise again if inflation does not continue to trend downward.

Analysts predict that the central bank might resort to further increases in the next few months, especially if inflation pressures continue or escalate. The financial markets are keenly watching any hints from the MPC about future policy changes, which could sway the economy in significant ways. Homebuyers with variable-rate mortgages and savers with cash holdings are advised to stay vigilant as these changes create ripples through financial planning and budgeting.

Conclusion

As the Bank of England continues to navigate a complex economic landscape, staying informed about interest rate changes is crucial for making sound financial decisions. For consumers, the stability of the interest rate at 5.25% may provide relief amidst rising costs, but it is essential to remain aware of the inflationary pressures that could prompt future hikes. Analysts forecast a cautious approach from the Bank, balancing the need for economic growth against the persistent threat of inflation. Keeping an eye on forthcoming MPC meetings will be vital as the UK economy develops and responds to both national and global economic conditions.

You may also like

Cheltenham gold cup 2026

Mortgage Rates Surge Past 5% Amid Market Turmoil

SEARCH

LAST NEWS

- Leslie odom jr to make West End debut in Hamilton

- Gordon Elliott Celebrates First Win at 2026 Cheltenham Festival

- St Patricks Day: A Celebration of Heritage and Transformation

- Aries Horoscope Today Astrology: March 13, 2026

- St Patrick’s Day 2026: Changes in Parking Regulations