Introduction

Fintech innovation has emerged as a critical driving force within the financial services sector, reshaping how consumers and businesses interact with money. With the rapid digitisation of financial products and services, fintech is not only enhancing customer experiences but also broadening access to financial solutions globally. As the industry continues to evolve, understanding the dynamics of fintech innovation becomes essential for stakeholders looking to navigate its complexities.

Current Developments in Fintech Innovation

Recent events highlight the significant advancements in fintech innovation, particularly in areas such as digital banking, blockchain technology, and artificial intelligence (AI). According to a report from Statista, the global fintech market is projected to reach approximately £460 billion by 2025, indicating a strong growth trajectory.

One pertinent example is the rise of neobanks, such as Monzo and Revolut, which have garnered millions of users by offering no-fee banking services through user-friendly applications. Additionally, blockchain technology is gaining traction beyond cryptocurrencies, with financial institutions exploring its potential for improving transaction security and transparency.

Moreover, the COVID-19 pandemic accelerated the adoption of contactless payments and digital services, with platforms like PayPal and Square reporting significant spikes in usage. The integration of AI is also playing a crucial role, with firms leveraging data analytics for fraud detection and customised financial products.

The Importance of Regulation in Fintech Innovation

Despite the promising developments, regulatory challenges remain a prominent concern in the fintech ecosystem. The Financial Conduct Authority (FCA) in the UK is actively working to ensure that innovation does not compromise consumer protection and market integrity. In 2023, the FCA launched a new regulatory sandbox to support fintech start-ups in testing their innovations while adhering to legal standards.

Conclusion

The future of fintech innovation appears bright, as technology continues to disrupt traditional financial models. With increasing competition, established banks are collaborating with fintechs to enhance their offerings, indicating a trend towards a more integrated financial landscape. As readers, it is crucial to stay informed about these developments, as they provide valuable insights into how fintech solutions can shape personal finance and business operations in the near future. The ongoing investment and interest in fintech innovation promise a financial world that is more efficient, inclusive, and responsive to consumer needs.

You may also like

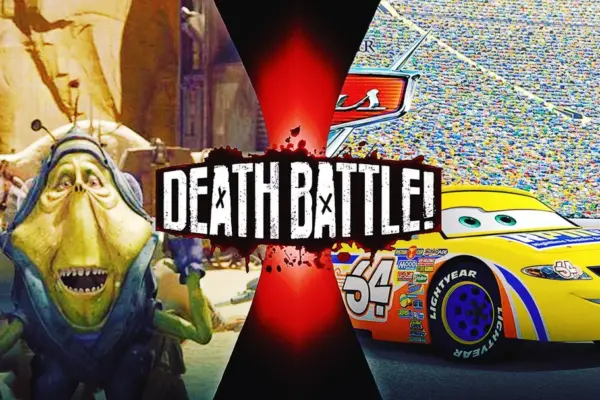

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football