Introduction

The share price of Advanced Micro Devices (AMD) is a significant indicator within the technology sector, influencing both investor sentiment and market dynamics. As a leading semiconductor company, AMD has been at the forefront of innovations in microprocessing and graphics technology, making its stock a focal point for investors and analysts alike. Understanding the fluctuations in AMD’s share price is essential for those looking to navigate the complexities of stock investment in the tech industry.

Recent Developments

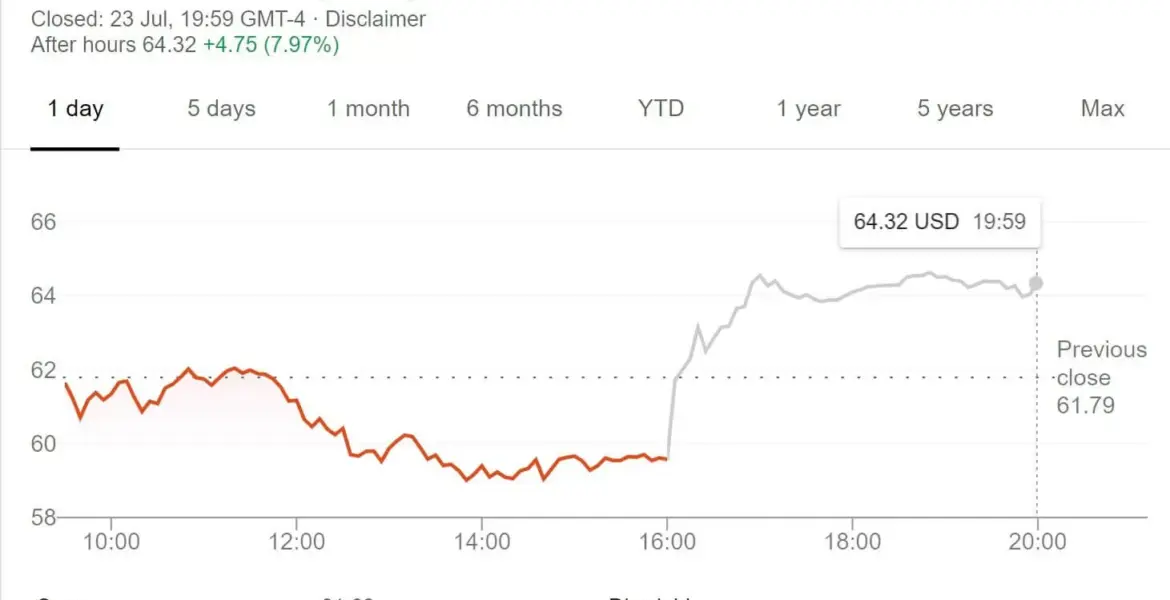

As of October 2023, AMD’s share price has experienced notable volatility. In the first half of 2023, the stock reached a peak of £110 per share, attributed to strong earnings reports and an increase in demand for its custom chips in gaming and data centres. However, in recent months, the share price saw a decline, dropping to around £85 following concerns regarding emerging competition and supply chain issues affecting the semiconductor industry.

Factors Influencing AMD’s Share Price

Several key factors have contributed to the fluctuations in AMD’s share price:

- Market Demand: The growing demand for AI and machine learning technologies has led many investors to keep a close eye on AMD’s innovations and product releases. Any announcements regarding new technologies can significantly impact share prices.

- Competitive Landscape: AMD faces intense competition from companies like Intel and NVIDIA. Any changes in market strategies or product releases from these competitors can affect AMD’s market position and subsequently its share price.

- Broader Economic Conditions: Global economic factors such as inflation rates, interest rates, and overall market sentiment play a crucial role in influencing investor behaviour towards AMD shares.

Conclusion

In conclusion, while AMD’s share price trajectory has shown both potential for growth and susceptibility to market pressures, it remains a vital element for investors monitoring the tech stock landscape. As the semiconductor industry evolves, investors should stay informed about AMD’s strategic developments and market conditions. Factors such as innovation, competition, and economic indicators will continue to shape AMD’s future performance and share price outlook.

You may also like

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial