Introduction: The Importance of BP Share Price

The share price of BP plc, one of the world’s leading oil and gas companies, is a critical indicator for investors and stakeholders in the energy sector. As global energy demands fluctuate and the transition to renewable energy accelerates, BP’s performance in the stock market reflects broader economic trends and investor sentiments. Understanding the dynamics of the BP share price is crucial for making informed investment decisions.

Current Events Impacting BP Share Price

As of October 2023, BP’s share price has experienced notable volatility, reflecting various factors including geopolitical tensions, oil market fluctuations, and company performance. Recently, BP announced its third-quarter earnings report, revealing a 20% drop in profits compared to the previous quarter, primarily due to a decline in crude oil prices. This announcement caused a temporary dip in share prices, which fell to approximately £4.90 from a peak of £5.30 earlier this month.

Additionally, the ongoing conflict in Eastern Europe and production cuts by OPEC have created a tense market environment for oil companies, contributing to uncertainty in BP’s operations and pricing strategies. However, BP’s commitment to transitioning towards sustainable energy sources has also garnered positive investor sentiment, as the energy sector pivots towards greener solutions.

Analysing Future Trends

Analysts indicate that the BP share price is likely to face further fluctuations in the coming months. Factors such as the upcoming COP28 climate conference, where nations will discuss emissions targets and energy strategies, could significantly impact BP’s market performance. Additionally, any potential mergers, acquisitions, or partnerships in the renewable energy sector may enhance or hinder BP’s positioning and future stock value.

Furthermore, predictions about global oil demand amidst the economic recovery from the pandemic may create additional volatility in BP’s share price. As emerging markets increase their energy consumption, BP’s investments in renewable technologies could serve as a stabilising force in its share performance.

Conclusion: The Significance for Investors

For investors, monitoring BP’s share price is essential not only for gauging corporate health but also for understanding broader market conditions in the energy sector. While the current trends suggest a turbulent time ahead, BP’s proactive shift towards renewable energy may provide substantial long-term gains. Investors should remain vigilant, analysing both BP’s financial strategies and external economic factors to make astute investment choices.

You may also like

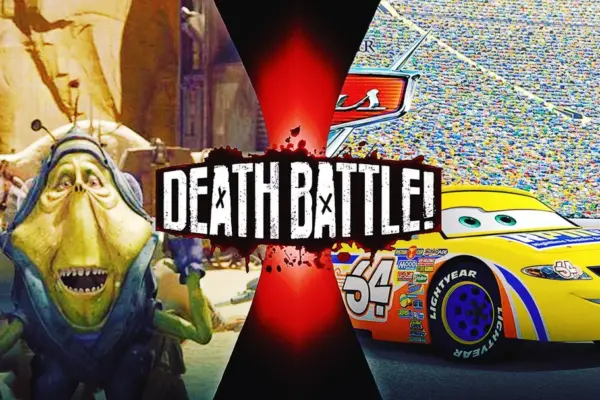

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football