Introduction

The state pension age (SPA) is a significant aspect of retirement planning in the United Kingdom, influencing how and when individuals can receive financial support from the government after they stop working. As the UK population ages and life expectancy increases, the government has implemented changes to the state pension age that impact millions of citizens. Understanding these changes is essential for current and future retirees, especially in light of ongoing discussions about sustainability and fairness in the pension system.

Recent Changes to the State Pension Age

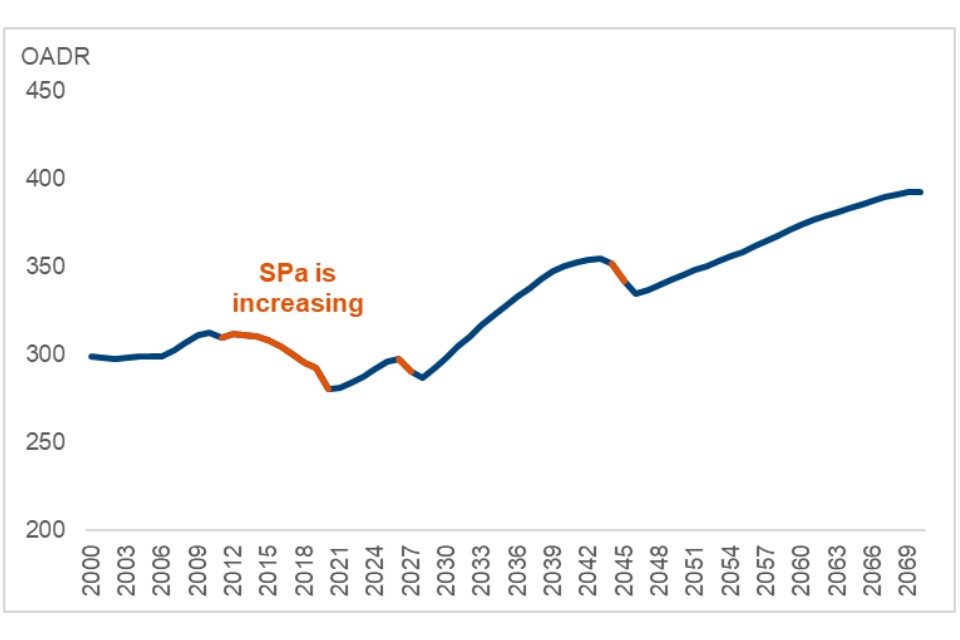

In 2014, the UK government announced increases to the state pension age, which are to take effect over the coming years. Presently, the SPA is set at 66 for both men and women. However, under plans outlined in the 2019 announcement and supported by the 2021 review, the SPA will rise to 67 by 2028. Furthermore, it is projected to increase to 68 between 2037 and 2039. These changes are part of the government’s strategy to cope with an ageing population and ensure the viability of the National Insurance Fund on which the state pension depends.

Impacts on Individuals

The adjustments to the state pension age have sparked considerable debate regarding their implications for individuals approaching retirement. Many people nearing the current pension age have expressed concerns about having to work longer than initially planned. The impact is particularly significant for those in physically demanding jobs or with health issues, who may find it challenging to continue working into their late sixties or early seventies. According to the Office for National Statistics, there is a growing disparity in life expectancies and healthy life expectancies among different socio-economic groups, raising questions about fairness in the pension system.

Government Response and Future Outlook

The government has faced criticism over these changes, with calls for more gradual transitions and considerations for vulnerable groups. In response to public outcry and feedback, the government has committed to reviewing the impact of the state pension age changes with a fresh eye on equity and accessibility. The next review of the state pension age is expected to occur around 2023, where the potential for further adjustments based on demographic studies and public consultation will be evaluated. Future journalists have suggested that more enhancements to occupational pensions and flexible retirement options might emerge as part of a broader retirement strategy.

Conclusion

The state pension age is a critical component of retirement planning in the UK, with recent changes prompting essential discussions about future expectations for retirees. While the government’s primary focus remains on the pension system’s sustainability, it is crucial to consider individual circumstances and the potential implications of increased pension ages. As reviews continue, individuals are encouraged to stay informed and assess their retirement funding strategies to navigate these shifts effectively.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price