Introduction to Gold Price Importance

The price of gold is a significant indicator of economic stability and investor sentiment. Fluctuating gold prices can affect a wide range of industries, including finance, jewelry, and manufacturing. With the rise in inflation rates and economic uncertainties, understanding the current trends in gold pricing is more vital than ever for investors and consumers alike.

Current Trends in Gold Pricing

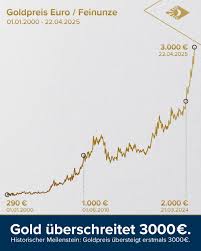

As of October 2023, the gold price has experienced considerable volatility. Recently, gold was priced at approximately £1,500 per ounce, which represents a decline of 5% from its peak in the previous month. Analysts attribute this fluctuation to multiple factors, including shifts in interest rates, geopolitical tensions, and consumer demand. Investors are closely monitoring the Federal Reserve’s decisions regarding interest rates, as higher rates typically dampen gold’s appeal as a non-yielding asset.

Global Economic Influences

The ongoing Russia-Ukraine conflict continues to create uncertainty across global markets, contributing to gold’s safe-haven appeal. Additionally, economic recovery in major economies like the US and China is causing debates about inflation rates and consumer confidence, directly influencing gold pricing. As the central banks react to these economic indicators, the gold market will likely remain sensitive to changes.

Investment Considerations

Investors are urged to consider the potential impacts of currency strength on gold prices. A stronger pound typically results in a lower gold price for UK investors. Furthermore, technological advancements in gold mining and recycling are improving the supply chain, affecting overall availability and price. Understanding these dynamics is crucial for making informed investment decisions.

Conclusion: Future Outlook on Gold Prices

As we look ahead, analysts forecast that gold prices will continue to reflect economic uncertainties. While short-term fluctuations are expected, long-term investors may find gold to be a resilient asset during periods of market instability. As inflation pressures persist and global tensions remain high, gold is likely to maintain its status as a critical investment during turbulent times. Investors are encouraged to stay informed about market changes and geopolitical developments to navigate the complexities of gold pricing effectively.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial