Introduction to Inflation

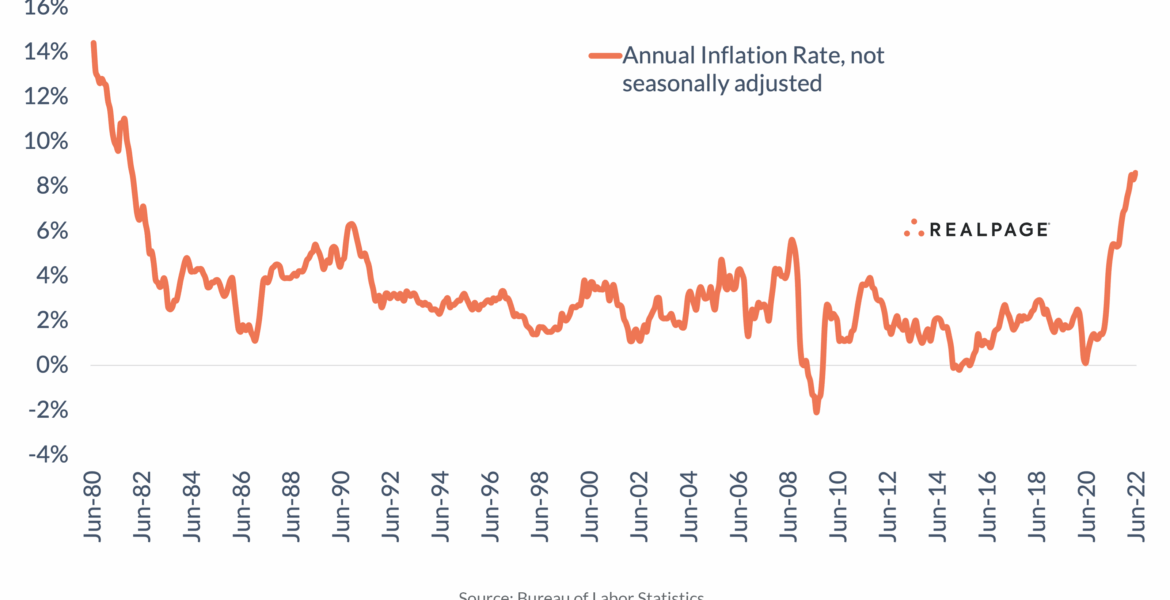

Inflation is a critical economic phenomenon that signifies the rate at which the general level of prices for goods and services rises, eroding purchasing power. In recent years, inflation has become a focal point for economists and policymakers worldwide due to its profound impact on daily life and economic stability. Understanding inflation is vital for consumers, businesses, and governments alike, especially in the context of recovering economies post-pandemic.

The Current State of Inflation

As of October 2023, inflation rates across many advanced economies are showing signs of stabilisation. In the UK, the annual inflation rate was recorded at 4.6% in September, a decrease from previous months where it surged above 10%. This decline can be attributed to various factors, including a fall in energy prices and tighter monetary policy by the Bank of England. However, the effects are still palpable as households and businesses continue to face increased costs in key areas such as food and housing.

Causes of Inflation

Inflation can arise from various sources, primarily divided into two categories: demand-pull and cost-push inflation. Demand-pull inflation occurs when the demand for goods and services exceeds their supply, often driven by increased spending from consumers and businesses. On the other hand, cost-push inflation results from rising production costs, like wages and raw materials. The current inflationary pressure has been partly driven by supply chain disruptions that have lingered since the COVID-19 pandemic, alongside geopolitical tensions influencing energy prices.

Effects of Inflation

The effects of inflation are wide-ranging, impacting everything from savings and investments to wage negotiations. For consumers, rising prices mean that each pound buys less over time, leading to potential decreases in living standards. For businesses, inflation can squeeze profit margins if they cannot pass on costs to consumers. Central banks, like the Bank of England, respond to inflation through monetary policy adjustments, which can include raising interest rates to curb spending and borrowing.

Conclusion: What Lies Ahead?

Looking forward, analysts warn that while inflation rates may continue to retreat, consumers and businesses should remain vigilant. Issues such as lingering supply chain challenges and the ongoing effects of global economic policies pose risks to sustained low inflation rates. The significance of inflation transcends simple economics; it shapes financial decisions, government policies, and ultimately, the quality of life for millions. As the UK and other economies navigate the post-pandemic landscape, understanding inflation will remain crucial for future financial well-being.

You may also like

Costa Coffee’s Commitment to Sustainability in 2023

The Villa Game: A Look into Its Current Landscape