Introduction

The topic of mortgage rates is of paramount importance to prospective homebuyers and investors alike. As interest rates continue to fluctuate in response to economic conditions, understanding mortgage rates today is crucial for making informed financial decisions. In October 2023, mortgage rates have drawn significant attention, primarily influenced by recent shifts in federal monetary policy and inflation rates.

Current Mortgage Rate Trends

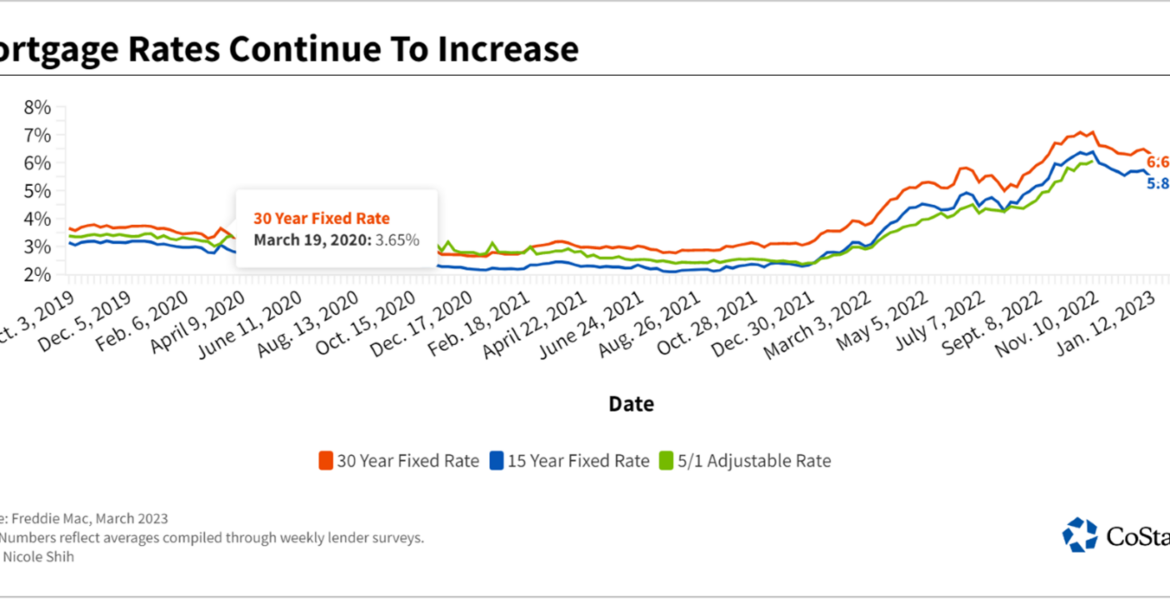

As of today, the average mortgage rate for a 30-year fixed-rate loan stands around 7.2%, a notable increase from approximately 3.1% just two years ago. This sharp rise in rates follows a series of interest rate hikes aimed at curbing inflation, which has reached levels not seen in decades. According to Freddie Mac, the uptick in mortgage rates can also be attributed to investors adjusting their expectations for economic growth, which have been influenced by recent reports highlighting persistent inflation and changes in the job market.

Impact on Homebuyers

The increase in mortgage rates has led to a slowdown in homebuying activity as many potential buyers are priced out of the market. A report from the National Association of Realtors indicates that home sales have dropped by approximately 17% year-on-year, leading to a more competitive environment for those still in the market. Additionally, first-time homebuyers, who often rely on lower mortgage rates to make homeownership more attainable, are particularly affected by these changes.

Future Outlook

Looking ahead, experts forecast that mortgage rates may continue to fluctuate in response to economic indicators. According to Bankrate, while rates might stabilise temporarily, further increases may be on the horizon as the Federal Reserve navigates its inflation objectives. Homebuyers should remain vigilant, monitoring not only mortgage rates but also external economic factors that could influence their purchasing power.

Conclusion

In summary, understanding mortgage rates today is essential for making informed decisions in an evolving real estate landscape. As rates continue to rise, potential buyers may need to reassess their budgets and explore alternative financing solutions. While the current market presents challenges, it also offers opportunities for those willing to adapt. The ongoing economic developments will likely define the future of mortgage lending and homeownership in the coming months.

You may also like

The Significance of Ben Quadinaros in Star Wars Podracing

Fluminense vs Botafogo: The Fierce Rivalry in Brazilian Football