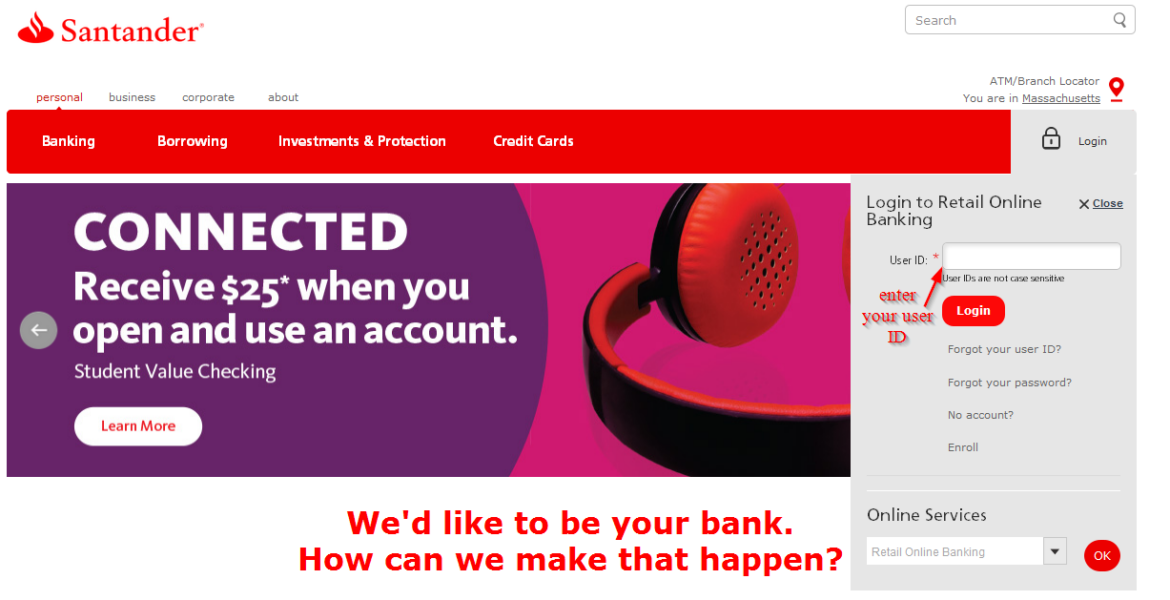

Introduction to Santander Online Banking

Santander Online Banking has become an essential tool for millions of customers, allowing for efficient and convenient management of personal and business finances. As traditional banking routines evolve, the digital landscape is critical in providing customers with unprecedented access to their accounts. This transformation not only improves banking experiences but also enhances overall financial literacy and management.

Key Features of Santander Online Banking

Santander’s online banking platform offers a plethora of features designed to streamline banking processes. Customers can easily perform day-to-day transactions such as checking balances, transferring funds, and paying bills. Additionally, the platform integrates budgeting tools that allow users to track spending patterns and save more effectively.

One significant aspect is the security measures in place. Santander employs robust multi-factor authentication processes, ensuring that customer data remains secure while accessible. The bank also employs real-time alerts for suspicious activity, offering peace of mind for users concerned about fraud.

Recent Developments and Enhancements

The bank has recently announced updates aimed at improving user experience. New functionalities include the introduction of biometric login options, such as facial recognition and fingerprint scanning for mobile apps, making it easier and safer for customers to access their accounts.

Furthermore, Santander is expanding its online customer service capabilities, offering live chat options and extensive FAQs to assist users promptly. This means that customers can receive immediate assistance regardless of the time of day, enhancing user satisfaction.

Conclusion and Future Outlook

As online banking continues to evolve, Santander is well-positioned to meet the demands of its customers through innovative solutions. The bank’s ongoing commitment to security and user experience suggests that it will remain a key player in the online banking environment.

Looking ahead, one can forecast that advances in technology, such as artificial intelligence and machine learning, will further enhance the banking experience. As customers increasingly rely on digital solutions, Santander is likely to invest in technologies that will continually improve efficiency and personalisation, ultimately shaping the future of banking.

You may also like

The Role of Metro Systems in Modern Cities

Costa Coffee’s Commitment to Sustainability in 2023